Aaron Kaufman, a new member of MCDCC and a strong supporter of the alcohol tax increase, passed along the results of a poll conducted by OpinionWorks for Maryland Citizen's Health Initiative.Overview

Our most recent Maryland statewide voter poll, conducted December 20-28, 2010 among 663 likely voters statewide, has found overwhelming support for an increased tax of 10 cents per alcoholic drink tied to funding health-related priorities. Two-thirds of likely voters support the proposed alcohol tax increase.

If dedicated to deficit reduction, support for the alcohol tax increase remains strong, with a solid majority supporting an alcohol tax increase. At a time of continuing economic stress for average households and little appetite for new taxes, there are strong indications that Maryland voters believe the State’s leaders should make an exception to pass an increased alcohol tax.

Detail

Strong Support for an Alcohol Tax Increase

Two-thirds of the electorate (66%) favor an increased tax of 10 cents per alcoholic drink if the revenue is dedicated to health-related priorities such as alcohol and drug treatment and prevention, health care for the uninsured, training for health care workers, and programs for people with developmental disabilities and mental health needs. A near-majority of 45% of Maryland voters say they “feel that way strongly” about their support. Less than one-third of voters (31%) oppose the alcohol tax increase.

A majority of 55% of Maryland likely voters support an increased alcohol tax tied to deficit reduction, with nearly four voters in ten (39%) saying they feel that way strongly.

Wednesday, January 26, 2011

Polling Shows Support for Alcohol Tax

Posted by

David Lublin

at

7:00 AM

![]()

![]()

Labels: Aaron Kaufman, alcohol, taxes

Wednesday, November 03, 2010

Now Comes the Hard Part

Today, Maryland Democrats are celebrating the reelection of Governor Martin O’Malley, U.S. Senator Barbara Mikulski and their holding onto both chambers of the General Assembly. But the reality of governance will soon set in. Why?

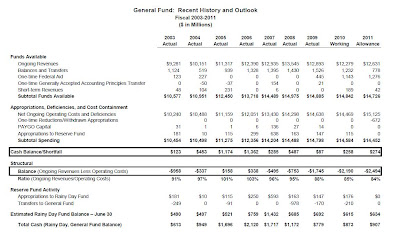

Because the Republicans have won control of the U.S. House of Representatives, and that means federal stimulus aid for the state government has almost certainly dried up.

Maryland’s state government has been subsidized by federal stimulus money under ARRA (the American Recovery and Reinvestment Act of 2009) for three fiscal years: 2009, 2010 and 2011. According to the state’s latest Spending Affordability Committee report, the state government has received $4.4 billion of stimulus funding over the last three fiscal years. The largest subsidies have been directed to Medicaid ($1.6 billion), education ($1.1 billion) and infrastructure ($781 million).

The stimulus funds have been invaluable for closing Maryland’s general fund deficits. In FY 2009, 2010 and 2011, the state racked up $6.4 billion in structural general fund deficits. It has used $2.9 billion of federal stimulus money to help close those deficits. That means federal money has been used to plug almost half of Maryland’s budget gaps.

With the election of a Republican U.S. Congress, that money is gone. And Maryland faces a general fund deficit in FY 2012 that could be as high as $1.6 billion. That leaves a number of unappetizing options to deal with it.

Budget Cuts

In FY 2011, 41% of all state general fund spending was sent as aid to local governments. By spending category (which overlaps local aid), 50% of the general fund goes to education, 24% goes to health care and 9% goes to public safety. Those three items combined account for 84% of the general fund in FY 2011. It’s probably impossible to have meaningful long-term spending cuts without touching one or more of these areas.

Teacher Pensions

In the 2010 session, the Senate passed a plan to phase in a partial handoff of teacher pension obligations to the counties. The plan would have saved the state no money in FY 2011, $63 million in FY 2012, $194 million in FY 2013 and more than $300 million annually in the out years. Those out year revenues are significant, but the state’s budget problems may necessitate collection of them earlier. So the General Assembly could well choose to accelerate the phase-in and make the counties assume a greater share of the cost than in the Senate’s plan.

Diversion of Transportation Revenues

The Transportation Trust Fund (TTF) claims over $800 million a year in state funding. The TTF’s revenues include vehicle titling fees (20%), gas taxes (19%), registration fees (15%), operating revenues (10%), sales taxes (6%), corporate income taxes (4%) and more. All are ripe for diversion to the general fund. The General Assembly has already seized transportation money due to the counties so state transportation money could be next. That would be a disaster for the state’s infrastructure, but if transportation advocates are pitted against education advocates, who do you think will win?

Tax Hikes

The three most discussed taxes are an extension of the millionaire tax (which was supposed to last for three years), the imposition of combined reporting to capture more corporate income taxes and an extension of the sales tax to services. The first two options will be resisted by the business community and both have very uncertain revenue generating capabilities. The last time the state tried to extend the sales tax to services, the result was the much-hated computer tax (which was repealed in 2008).

Casting a long shadow over the taxation debate is the state’s competitive position with its neighbors – especially Virginia. The Tax Foundation’s FY 2011 tax competitiveness report ranks Delaware #8, Virginia #12, Pennsylvania #26, West Virginia #37 and Maryland #44 of the fifty states. Here is how Maryland compares to Virginia on a few tax measures.

Corporate Income Tax

Maryland: 8.25%

Virginia: 6.00%

Top Income Tax Rate

Maryland: 6.25% (at $1 million income)

Virginia: 5.75% (at $17,000 income)

Sales Tax

Maryland: 6%

Virginia: 5%

Maximum Unemployment Insurance Tax Rate

Maryland: 13.5%

Virginia: 6.2%

At least the state will not have to pay for Bob Ehrlich’s proposed $700 million sales tax cut.

Now what were we saying about celebrating?

Posted by

Adam Pagnucco

at

2:00 PM

![]()

![]()

Labels: Adam Pagnucco, budget, State Aid, taxes, Teacher Pensions, transportation

Friday, October 29, 2010

Bob Ehrlich: The Anti-MoCo Candidate, Part Three

Bob Ehrlich depicts himself as a tax cutter. Isn’t that good for Montgomery County?

It depends on which taxes you’re talking about.

Taxes

Ehrlich has made criticism of Governor O’Malley’s 2007 special session tax package a centerpiece of his campaign. His primary tax proposal is to repeal the special session’s one-cent increase in the sales tax, which accounted for a majority of the tax package. Ehrlich characterizes the sales tax as regressive. It certainly is, but these are crocodile tears from the former Governor. He expressed his real feelings about the working class by closing the state office that enforced child labor, minimum wage and other labor standards in 2005.

If Ehrlich does repeal the sales tax increase, who would benefit the most? The following chart illustrates per capita sales tax payments for every Maryland county (as well as Baltimore City).

In FY 2009, the average Maryland sales tax paid per capita was $591. That amount was highest in tourist centers like Ocean City (in Worcester County) and Saint Michaels (in Talbot County) and in Central Maryland jurisdictions like Anne Arundel and Howard Counties. MoCo’s per capita sales tax payment ($543) is actually 8% less than the state average, so MoCo gets relatively little out of this tax cut – especially given how Ehrlich would pay for it. (More on that later.)

Ehrlich does not have much of a record of cutting taxes, but he does have a record of raising one tax in particular: the state property tax. In 2003, Ehrlich voted in favor of a property tax hike from 8.4 cents to 13.2 cents for every $100 in assessed value on the Board of Public Works. (The board cut the rate back to 11.2 cents in 2006.) That tax hike raised a net $692.9 million over four years. The state does not report its property tax revenues by county, but it does report each county’s assessable base, which drives property tax payments. Here is the estimated assessable base per capita for the tax year starting on 7/1/11.

MoCo accounts for one-sixth of the state’s population and one-quarter of its assessable property base. Its assessable base per capita (an estimated $188,910 next year) is 47% higher than the state average ($128,151). This is the major tax hike that Ehrlich chose in his first year in office – a tax hike that disproportionately hit MoCo.

So Ehrlich would cut the sales tax, which would primarily benefit other counties, but he raised the property tax, which primarily hit MoCo. How would Ehrlich pay for his sales tax cut? We learned the answer to that in Part Two: he would cut MoCo’s education funding and saddle MoCo with responsibility for teacher pension payments. This set of positions in addition to his throwing in the towel on the Purple Line and transportation funding is diametrically opposed to Montgomery County’s economic interests.

That’s why Bob Ehrlich is the Anti-MoCo candidate.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, Martin O'Malley, Property Taxes, Robert Ehrlich, taxes

Monday, August 02, 2010

Forehand vs. Kagan on Taxes and Budget

Posted by

Adam Pagnucco

at

10:00 PM

![]()

![]()

Labels: budget, Cheryl Kagan, District 17, Jennie Forehand, taxes

Monday, June 07, 2010

County Council At-Large Candidates on Taxes

After concluding its endorsements, the Montgomery County Education Association (MCEA) posted the questionnaires it had received from candidates on its website. Some of the questions pertain to issues of no great importance to people outside the union. But others are of interest to many. We are digging through the answers provided by the County Council At-Large candidates on a series of questions of considerable value this week and hope this aids our readers.

The candidates who completed the questionnaires are incumbents Marc Elrich, Nancy Floreen and George Leventhal, Democratic challengers Jane de Winter, Fred Evans, Hans Riemer and Becky Wagner and Republican challengers Robert Dyer and Brandon Rippeon. Incumbent Duchy Trachtenberg did not complete a questionnaire because she is not seeking union endorsements (unlike four years ago).

Our first question from MCEA’s questionnaire is: What is your view of the current local tax structure? What, if any, changes would you advocate?

Marc Elrich

I supported Al Carr’s bill to enable us to have a split rate tax system (commercial and residential property with potentially a higher rate on commercial) and will support it again if it’s introduced (only Phil and I supported it the first time.) I supported Rich Madaleno’s bill to give the county the right to create a transit taxing authority so we can raise taxes on property that would benefit from the construction of major transportation projects, such as my BRT proposal. In a perfect world, the State would have a more progressive income tax, and County’s would share in the corporate income tax. I’m especially interested in this because the cost of infrastructure for business expansion is borne at the local level, yet the State is the sole beneficiary of the income taxes.

Several years ago I supported the County Executive’s tax proposal to increase the rate but also the homeowner tax credit. Had we done that we’d have had another $100 million dollars this year and the furloughs and many of the painful service cuts would not have been necessary. The Exec was right in projecting our long-term revenue needs, but I lost the vote on the council 8-1.

Nancy Floreen

At this point, I think we’ve pushed it to the limit.

George Leventhal

I would support a charter amendment to remove the fire tax from the constraints of the Ficker amendment. I hope we can successfully rezone targeted areas of economic opportunity like White Flint, the Great Seneca Science Corridor, Wheaton, Glenmont and the Science Center East at White Oak/FDA. In so doing, we will increase land values and expand our property tax base. We need to get back to relying on property tax revenue rather than regressive nuisance taxes like energy and cell phone taxes. Expanding jobs and investment in these targeted areas of economic opportunity will also increase income tax revenues.

Jane de Winter

As an Economist I believe that the most efficient tax structure is broad based taxes unless we are specifically seeking to encourage or discourage certain types of economic activity. I would support a more progressive structure in the state and piggy back tax than we have now—there is very little progressivity. When residential property tax rates are increased I support using a mix of rate increases and credits to assist low income property owners so that the property tax also has some progressivity. I am in favor of exploring development tax districts to raise funds for development related infrastructure needs. I was not and am not in favor of the Ficker Amendment which requires nine votes to raise property taxes above the charter limit. When considering new revenue options, we need to have a thorough understanding of the impact on economic activity.

Robert Dyer

Property taxes are too high. Once the structural deficit has been addressed, we need to reduce property taxes. I have a plan to create at least 8 new revenue streams of varying amounts so that we can reduce the burden on the taxpayer. These include a voluntary income tax and voluntary gas tax program.

Fred Evans

Due to the national and state budget crises, the "trickle down" effect on local jurisdictions has created an economic disaster. I do not believe that the "local tax structure" is as much of the problem as our ability to predict these situations and be prepared for them. Therefore, I would advocate that a thorough fiscal analysis be completed involving all stakeholder groups to determine next steps and what steps to take in order to avert future economic disasters. Since I am not a fiscal specialist, I would depend on "experts" to give us a realistic framework for the future.

Hans Riemer

I have three concerns when I consider our tax structure:

1) Taxes must only be high enough to generate revenue to pay for the vital services the county provides, and no higher. Surpluses should be saved for rainy days and also returned to the taxpayers. During the boom times of our recent past, however, the County Council raised taxes, and now there are few alternatives for raising revenue.

2) The tax structure should be fundamentally progressive and it should be broad-based rather than singling out particular groups of people for unfair burdens. It cannot place an unrealistic burden on the poor, elderly or otherwise disadvantaged. In the property tax context, the state of Maryland has a Homeowner Tax Relief program designed to protect lower income families and the elderly and disabled from losing their property because the assessments and tax rates on their property has gone up and they can no longer afford them, and Montgomery County has taken steps to expand this program, both in terms of eligibility and the extent of relief. We must ensure that these programs and the income limits governing eligibility (currently $64,000) keep pace with inflation and any changes in the property tax rates.

3) Our tax burden must be competitive relative to other jurisdictions in our region. We do not need to have the lowest taxes, and we have a higher quality of life in Montgomery County because we are willing to pay for it. But we do have to be vigilant to ensure that the tax burden in this county does not grow so high compared to Northern Virginia or DC that we cannot compete for jobs. A 2009 DC government survey estimated the average total tax burden on a family of three making $100,000 a year would be $10,104 in Montgomery County, compared to $7,938 in DC, $8,276 in Alexandria, $8,417 in Arlington County and $8,347 in Fairfax County.

Brandon Rippeon

The current local tax structure is too high. I advocate a freeze on additional taxes.

Becky Wagner

I think it is more than unfortunate that the Ficker Amendment passed in 2008. There are times when new or increased taxes are necessary to fund the services that we value. That said, the piecemeal approach of tax increases begs for a comprehensive review and decision regarding what we want to fund, and how we intend to do so. In reality we have to grow our revenue base in the County by increasing opportunities for the business community to thrive here. Good jobs and thriving businesses pay for our quality of life.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Becky Wagner, Council At-Large, Fred Evans, George Leventhal, Hans Riemer, Jane De Winter, Marc Elrich, Nancy Floreen, Robert Dyer, taxes

Monday, May 24, 2010

Consequences of the Budget, Part One

The FY 2011 budget passed by the Montgomery County Council is an historic event. Many things that would have seemed unthinkable just a few years ago happened at the same time: double digit funding reductions in many departments, no pay increases for employees, furloughs, repeal of a negotiated pension benefit, serious questions about the county’s AAA bond rating and an absolute drop in county spending. This was a moment when the unreal became all too real.

Let’s understand that few of the above decisions were made willingly. The nearly billion dollar deficit was created by a horrendous recession and a resulting massive drop in income tax collections. Suddenly, the county’s tax base was nowhere large enough to support the $4+ billion government it had built up in good times over prior years. Some, like County Executive Ike Leggett, Council Members Marilyn Praisner and Phil Andrews and a few merit staffers had warned that the big spending increases approved during Doug Duncan’s last term would be unaffordable over the long run. But no one believed the crash would hit with such acute and devastating force.

The County Executive proposed a Fiscal Year 2011 budget that reduced county spending by 3.5%. The budget passed by the council contained an overall reduction equaling that amount, but there were differences with the Executive’s proposal. For the record, here is a comparison between the Executive’s last budget of April 22 and the final budget passed by the council.

The events of the last few months will have wide-ranging implications in a variety of ways. First, the specific tax hike chosen by the county to help close the deficit will have dire competitive consequences. Second, the County Council’s relationship with the school system and the unions has fundamentally changed over the medium term. Third, the extremely serious challenges for the county’s long-run financial viability are becoming impossible to put off. And finally, all of the above will have political impact. Over the course of this week, we will examine each of these items in turn.

Taxes

The most consequential decision in the budget process was one that was made by both the County Executive and the County Council very early on: not to break the charter limit on property taxes. The county’s charter requires a supermajority vote by the council to raise property taxes above the rate of inflation. The council voted to break that limit four times in seven years (FY 2003-2005 and FY 2009) in fiscal times that were not nearly as bad as now. The voters replied by passing the Ficker Amendment, which raised the supermajority required to break the limit from seven council votes to all nine. County elected officials perceived pushback from the electorate and vowed not to break the limit again – especially not in an election year.

This decision had a powerful impact on the budget. Property taxes account for 51% of all local tax revenues. The county already charges the maximum amount allowed by state law – 3.2% - on its income tax and that accounts for another 39% of local taxes. So now 90% of the county’s revenues were off the table for increases. The energy tax, which accounts for just 5% of local taxes, was the biggest remaining revenue item and so the executive branch targeted it for a hike.

But the problem with the energy tax is that it disproportionately impacts business customers, who pay 73% of the total levy. The Executive originally proposed increasing the tax by 39.6%. But warnings by bond rating agencies prompted him to revise the increase to 63.7% and a revenue writedown caused him to propose doubling it.

A council memo illustrated the devastating competitive consequences of that idea. Here is a comparison of the rates commercial customers would pay between different jurisdictions if MoCo’s energy tax had been doubled.

In the end, the council increased the tax by 85% but split the increase 50-50 between residents and businesses. Business customers faced a 58% tax hike. One council source explained it this way:I think the decision to reduce the energy tax for the business community was a significant move for a council that is often thought of as anti-business. We reduced it by 42% from what Ike originally proposed through a combination of reallocation to residential customers (i.e., voters) and reduction of the overall tax by 15%. Ike’s proposal was almost obscene in terms of its impact on small business.

That may be true, but because the county made a political decision to avoid the property tax, it instead chose to rely on a job-killing measure that targets employers to help close its budget gap. (Fairfax chose to raise its property tax rate to deal with its own budget crisis.) Even with the reduction in the energy tax hike passed by the council, MoCo charges a FAR higher rate than its competitors. And MoCo raised this tax right after losing Northrop Grumman. Here is a transcript of a conversation between two business owners that will almost certainly take place at the next board of trade networking luncheon.Business Owner A: “I’ve maxed out on my office space and am looking to move. What do you think about Montgomery County?”

This sort of talk will go on for a long, long time and will be a BIG problem in attracting jobs. No new economic development authority will compensate for it.

Business Owner B: “They have a big, liberal government that spends a lot of money. And when they get into trouble, they sock it to business.”

Business Owner A: “Guess I’m not moving there!”

We’ll look at the schools tomorrow.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, County Budget 2010, energy, taxes

Thursday, May 06, 2010

Three Hospitals Call for Lower Energy Tax Hike

Holy Cross Hospital, Montgomery General Hospital and Suburban Hospital have sent a joint letter to the County Executive and the County Council asking for a reduced energy tax increase (which the Executive has proposed doubling) that would be levied on a temporary basis. Following is the letter.

May 5, 2010

The Honorable Isiah Leggett

Montgomery County Executive

Executive Office Building

101 Monroe Street

Second Floor

Rockville, MD 20850

The Honorable Nancy Floreen

President

Montgomery County Council

100 Maryland Avenue

Rockville, MD 20850

Dear County Executive Leggett and Council President Floreen:

On behalf of Holy Cross, Montgomery General and Suburban Hospitals, we are writing to share our serious concerns regarding the proposed 100 percent increase in the county energy tax.

At the outset, we want to emphasize that we understand and appreciate the difficult budgetary decisions you and the members of the County Council face. There are no easy decisions associated with having to close a billion dollar budget gap – particularly as the demand for services due to the economy increases. We also recognize all stakeholders need to be part of the solution.

For our hospitals, the proposed increase collectively equates to $1,200,428, broken down as follows:

Holy Cross – $560,000

Montgomery General – $298,734

Suburban – $341,694

A tax of this magnitude, on top of significant hospital Medicaid cuts and an increasing demand for services as a result of the economy, will have a material negative impact on our continued ability to provide services the residents of Montgomery County need and deserve.

Following the budget cuts contained in the state’s FY 2010 budget, hospitals were forced to absorb an additional $27.5 million in cuts taken by the Board of Public Works and $106 million in averted uncompensated care funding. This difficult situation was further exacerbated by the heavy impact of the February snowstorms. And, the FY 2011 state budget recently adopted by the General Assembly contains a further $123 million in Medicaid reductions to hospitals.

Unlike other businesses, hospitals in Maryland cannot simply pass additional costs onto our customers. As you know, the rates Maryland hospitals can legally charge are established by the Health Services Cost Review Commission. And, unlike hospitals in other states, we cannot cost-shift government underpayments and taxes to private commercial insurers. These additional costs come off the already slim and decreasing margins of our hospitals.

Unlike other energy consumers, hospitals are limited in their energy conservation options. Hospitals are 24/7 operations, very dependent on technology, and required to comply with a multitude of government regulatory requirements. Turning off lights, lowering the heat, etc. are often not viable options for us.

As not-for-profit entities, the margins hospitals generate are reinvested back into our facilities, our employees, and our communities – the exact types of reinvestments that serve to strengthen Montgomery County’s economy. In addition to the community health and wellness programs each of our hospitals provides independently to Montgomery County residents, we have partnered with the County on many occasions to further address the unmet health care needs of our communities. Examples of our support include: expanding clinics to serve the Montgomery Cares population, and funding for the recent community health needs assessment by the Urban Institute.

The energy tax proposal represents a real and significant additional cost to the hospitals in Montgomery County. As the debate moves forward, we ask that you take these factors into account and we request consideration of a lower increase in the proposed energy tax for the not-for-profit hospitals in Montgomery County. In addition, we believe it is critically important that the increase in the energy tax be sunset. Any increase in the energy tax should be a short term bridge to enable the county to continue to provide essential services during these extraordinary economic times.

Thank you for your consideration of our perspectives. We would welcome the opportunity to further discuss with you the issues and implications for our hospitals.

Sincerely,

Kevin J. Sexton

President

Holy Cross Hospital

Peter W. Monge

President

Montgomery General Hospital

Brian A. Gragnolati

President

Suburban Hospital

Posted by

Adam Pagnucco

at

4:00 PM

![]()

![]()

Labels: County Budget 2010, energy, Holy Cross Hospital, Montgomery General Hospital, Suburban Hospital, taxes

Wednesday, May 05, 2010

Push Poll on Berliner Carbon Tax

Multiple sources have reported receiving phone calls amounting to "push polls" on Council Member Roger Berliner's proposal to tax carbon emissions from Mirant's fossil fuel power plant in Dickerson. The caller recites a variety of information about the proposal, often too quickly for the recipient to hear, and then asks whether the recipient agrees with the tax. Based on the feedback we have received, we do not believe the push poll will be very effective.

Posted by

Adam Pagnucco

at

11:00 PM

![]()

![]()

Labels: Mirant, Roger Berliner, taxes

Thursday, April 29, 2010

Business Groups Band Together to Fight Energy Tax

Thirteen business organizations have sent a joint letter to the County Council protesting the County Executive's proposal to double the energy tax. They have attached some truly eye-popping numbers on what the tax would cost MoCo businesses.

Following is the letter and the data supplement.

April 29, 2010

Councilmember Nancy Floreen, President

Montgomery County Council

100 Maryland Avenue

Rockville, MD 20850

Re: Expedited Bill 15-10 Taxation-Fuel-Energy Tax – Rate and Resolution to Change Fuel/Energy Tax Rates

Dear Council President Floreen and Councilmembers:

As organizations representing more than 5,000 businesses throughout Montgomery County, together we are writing to you to express our deep concerns regarding County Executive Leggett’s proposed energy tax increase.

As you face what are some very difficult budget decisions this year, we would like to make you aware of what some of the negative impacts will be on job retention and creation if you choose to enact the 100 percent increase in the energy tax proposed by the County Executive. We believe that this approach, while filling a short term budget gap, ignores what are some serious long term implications of the action.

Many of our business members have worked very hard over the past few years to reduce their energy consumption levels in order to reduce energy costs and preserve jobs. The 100 percent increase not only wipes away these cost savings that have been achieved but places yet an additional burden on businesses, small and large, that they simply cannot afford. Our commercial property owners tell us that their delinquency rates from small local and regional retailers are higher than ever, and every day landlords in Montgomery County are working on rent relief agreements in order to keep these businesses in their current locations. Many of these businesses, because of various constraints, simply cannot pass this cost on to their customers.

In addition to the impact on current small business owners, the increase runs totally contrary to Montgomery County’s economic development strategy. Montgomery County’s focus on high technology and biotechnology will be undermined by tax increases to some of these companies of over $500,000 annually. These companies have indicated to us that the size and scope of this increase means that engineers, nurses, and many other skilled workers will not be hired because of the increased costs of doing business here in the County.

While many have applauded the idea that this tax hits our federal government facilities, it seems an inopportune time to place a burden on these federal facilities while we are in a difficult competition to keep the Department of Health and Human Services in Montgomery County. In the next 3 years, 60 out of 90 federal agency leases in Montgomery County will be up for renewal. We need to be in a strong position to compete with the District of Columbia, Prince George’s County, and Northern Virginia to retain these tenants.

We believe that this is the right time for County government to reexamine its priorities, focus on essential government services and take a serious look at government consolidation in order to eliminate duplication of services and achieve savings.

The only way to have a sustainable future for Montgomery County is to be competitive with our regional neighbors and grow our tax base through the attraction and retention of jobs. This tax increase significantly undermines the County’s ability to achieve this objective.

Thank you for your consideration.

Sincerely,

Ms. Janice M. Freeman, President

African American Business Council

Margaret O. Jeffers, Esq., Executive Vice President

Apartment and Office Building Association of Metropolitan Washington

Marilyn Balcombe, Ph.D., President/CEO

Gaithersburg-Germantown Chamber of Commerce

Ginanne M. Italiano, President & CEO

The Greater Bethesda-Chevy Chase Chamber of Commerce

Jane Redicker, President & CEO

Greater Silver Spring Chamber of Commerce

James Dinegar, President & CEO

The Greater Washington Board of Trade

Edward “Guy” Curley III, President

Maryland-National Capital Building Industry Association

Richard Ehrenreich, Executive Director

Mid-Atlantic Association of Cleaners

Steve Elmendorf, Esq., Legislative Committee Chair

MD/DC NAIOP

Georgette Godwin, President & CEO

Montgomery County Chamber of Commerce

Virginia Mauk, Executive Director

Olney Chamber of Commerce

Andrea Jolly, Executive Director

Rockville Chamber of Commerce

Renee Winsky, Chief Executive Officer

Technology Council of Maryland

Posted by

Adam Pagnucco

at

1:00 PM

![]()

![]()

Labels: Chamber of Commerce, County Budget 2010, energy, taxes

Monday, April 26, 2010

Is the Energy Tax a Job Killer?

On March 15, the County Executive proposed increasing the energy tax by 39.6%. On March 25, he proposed increasing it by 63.7% because of threatened downgrades to the county’s bonds by credit rating agencies. On April 22, he proposed doubling it to compensate for a $168 million revenue writedown. The tax is politically convenient since the vast majority of it falls on business consumers. But is this any way to encourage the creation of badly needed jobs?

The energy tax is structured to fall disproportionately on businesses. Currently, residential customers pay $0.005224 per kilowatt of electricity and $0.044986 per therm of heating fuel per year. Business customers pay $0.013843 per kilowatt of electricity and $0.119214 per therm of heating fuel per year. So businesses pay 2.65 times the rates of residential customers and account for 72.8% of all revenues the tax takes in.

The Executive’s March 25 proposal would have hiked rates 63.7%, pushing up the average residential bill by $62 per year and the average non-residential bill by $1,539. The total revenue raised by the tax would have increased from $132 million in FY 2010 to $217 million in FY 2011. (The tax raised just $26.1 million in FY 2003, so it would be increasing by more than eight times in eight years.)

In a hearing about that tax hike last Tuesday, Pepco representative Charles Washington presented data on what that would mean. Washington testified:As demonstrated below using actual randomly selected commercial accounts, this increase will have a real impact on County businesses. One restaurant in Silver Spring will see an increase of over $3,000 a year. A hotel in Bethesda will see a tax increase of approximately $41,000 a year. The County’s successful Biotech companies will see increases of hundreds of thousands of dollars of year, with at least one projected to see an increase of over half a million dollars.

Washington also said this:The County’s Fuel/Energy increases since 2003 have always disproportionally impacted commercial customers. However, this proposed increase crosses a notable threshold. Pepco, a distribution company, collects approximately $88.6 million in distribution revenues from commercial customers in Montgomery County. As illustrated below, if the County Executive's proposal is approved, the County would collect over $130 million from those same customers. In essence, the County will be collecting more from the energy tax than Pepco collects as a power delivery company to maintain and operate our electric system.

That’s right, business customers will be paying more to the government for their electricity than to Pepco!

At the same hearing, a representative from Suburban Hospital testified that her facility would pay more than $200,000 in extra taxes from the proposal. The Washington Adventist system and Holy Cross Hospital, each of which are bigger than Suburban, would presumably pay hundreds of thousands each. The plight of the hospitals is quite dire since the rates they charge to patients are set by the state and they cannot simply pass on the increases. The hospitals are likely to take the extra costs out of charitable care services provided to the poor. These same poor people will be suffering from huge county budget cuts.

Since the hearing, the County Executive has revised his proposal to double the energy tax. So all of the above data on tax increases must be increased by half to be current. That means the biotech company cited by Pepco would be paying over $750,000 in extra taxes every year.

The proposed tax hikes are occurring in the context of significant economic decline in the county. Employment has fallen from a peak of 472,567 in December 2006 to 443,022 in September 2009 (the most recent month available from the Bureau of Labor Statistics), a drop of 6.3%. The county’s unemployment rate was 5.9% in February 2010, up from 2.5% in April 2008. Income tax revenue is down by 13% in FY 2010 and net taxable income has declined by massive amounts at the bottom and top ends of the income distribution.

Furthermore, the tax hike threatens to exacerbate the county’s increasing competitiveness gap with Fairfax. If the county doubles its energy tax, its consumers will be paying over $260 million per year in FY 2011. Fairfax, which is a slightly larger county, plans to collect $50 million in energy taxes in FY 2011. So Montgomery’s businesses could be paying five times more in energy taxes than their competitors in Fairfax.

Given the county’s nearly billion dollar deficit and the colossal cuts planned for public services, it makes sense that the county would consider some tax component in its deficit reduction package. In any other year, the council would probably break the property tax charter limit, thereby enacting a small tax increase spread across a large number of payers. But this is an election year and the county leaders do not want a powerful symbolic issue like a charter limit break to be a major story close to election time. So the resulting energy tax hike is both large and narrowly targeted: at the people who create jobs.

In his last State of the County address, the County Executive said, “There may be nothing more important to the well-being of our community than protecting, creating, and attracting jobs…” His planned $4 million subsidy for Costco is allegedly intended to further job creation. He is supporting an initiative by Council President Nancy Floreen to create a Montgomery Business Development Corporation, again to encourage job creation. But none of this means anything if the county’s marquee employers face hundreds of thousands of dollars in fresh tax increases while small businesses suffer yet another threat to their eroding bottom lines.

It is always important to evaluate a politician’s words against a politician’s deeds. Remember this the next time an elected official claims to favor this tax hike while also discussing the need for more jobs.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, County Budget 2010, Economy, energy, Ike Leggett, taxes

Friday, April 16, 2010

Leaders Facing Fiscal Challenges

Now is not an easy time to govern. Revenues are down--way down--and officials at the state and county level can only offer an unpalatable menu of reduced spending and higher taxes. Neither is appealing to an electorate and one suspects that sounds of distress arising from the land will only increase as the General Assembly comes home to campaign and the County Council wrestles with the budget.

In the ongoing budget debates that will continue long beyond the primary or the general elections, it's easy to demand funding for cherished programs or rail against tax increases. It's a lot harder to say what tax you'd raise or other program you'd cut to pay for them. Amid the cacophony, several leaders at different levels of government have impressed me with their willingness to grapple with tough issues. I thought I'd highlight a couple of them here:

(1) Aaron Kaufmann, Vice Chairman of the Montgomery County Commission on People with Disabilities, could just highlight the many challenges faced by disabled people as part of his fight to secure more funding for disabled people. They're certainly a compelling group even in tough times and Aaron is a strong advocate.

Instead, Aaron has not just asked for funding but taken the far tougher road of not just advocating for more funding but coming up with a specific funding mechanism: a five-cent increase on the alcohol tax. Would that every person advocating for more spending or lower taxes be so forthright.

(2) County Councilmember Marc Elrich would have pleasanter meetings, and probably an easier reelection bid, if he would agree to advocate for more spending on worthy causes when speaking with constituents. Instead, the liberal councilmember has taken a page from Nancy Reagan (!) by just saying no. As the Gazette reports:Elrich has met with many people who want money restored in the county's fiscal 2011 budget for worthy projects and services, and he has said the same thing to all of them: "No."

No doubt there are many other examples of fiscal backbone and public officials making hard choices. Feel free to mention your favorite examples in the comments. It would improve our public discourse in these fiscally tough times if not just public officials and candidates but constituents as well would follow the challenge outlined by Aaron and Marc and tell us how you'd pay for any increased spending or cut in taxes.

"I've told everyone I'm not putting a dime back in the budget," he said.

The council learned Tuesday that County Executive Isiah Leggett (D) will revise his budget proposal to include an additional $168 million in cuts.

Elrich said it is understood that no "pet projects" will be pushed through this year. "I can't think about how I add that without imagining where I'll subtract it from," he said.

The recent fracas over teacher pensions in the General Assembly shows how valuable these debates can be and the difficulties faced by legislators who not only have to cope with demands by constituents who have real needs but other legislators who likely have a different set of preferences. You may hate Sen. Rich Madaleno's work on this issue in the past session but budgeting is making choices and he was willing to engage in the debate and make tough choices as part of his effort to fight off worse options for the County.

It's fine to argue against these choices as many have, and certainly no one has the monopoly on wisdom, but to be credible in my book you have to lay out real options and spell them out in meaningful detail. You favor higher taxes? Then tell us how much the taxes would go up and on whom to fund your program. You favor lower taxes? Then tell us which programs you'd eliminate. (And pointing to old saws like "waste, fraud, and abuse" or talking in vague terms about budget reforms doesn't cut it.)

When sizing up candidates this year, look not just at their priorities but at their ability to deal responsibly and honestly with the public. If someone is telling you something that sounds too easy in these tough times, check your wallet.

And yep, it applies to me too. I'm the Town Treasurer and have to outline the budget proposed by the Council at the Town of Chevy Chase's Annual Meeting on May 4th at the Lawton Center.

Posted by

David Lublin

at

12:00 PM

![]()

![]()

Labels: Aaron Kaufman, budget, Marc Elrich, taxes

Wednesday, April 07, 2010

How Would Ehrlich Balance the Budget?

At his campaign announcement this morning, former GOP Governor Bob Ehrlich said he would seek a repeal of the 2007 increase in the sales tax from 5% to 6%. But given the state’s massive fiscal problems, how can Ehrlich do that and meet his constitutional requirement to balance the budget?

Maryland is facing gigantic budget deficits as far as the eye can see. A November fiscal update shows structural deficits of more than $2 billion per year every year through FY 2015.

A sales tax cut would make matters worse. A group of Republican Delegates sponsored a bill this year that would reduce the sales tax from 6% to 5%, which is exactly what Ehrlich is proposing. The bill’s fiscal note estimates that the cut would deprive the state of more than $700 million a year by FY 2014. And since the Transportation Trust Fund receives a small portion of the sales tax, transportation spending – a major priority of the business community – would take a hit too.

Here is what the state structural deficits would look like before and after the tax cut.

Let’s keep in mind how big these deficits would be. Three billion dollars is almost a quarter of the state’s $13 billion general fund in FY 2010. That sum exceeds what the state spends on higher education, the state police, foster care payments and the judiciary combined.

So how would Ehrlich balance the budget? His campaign statement does not include a no-new-taxes pledge but does promise to “fix” the budget and help small businesses. It is noteworthy that immediately after his election last time, Ehrlich raised property taxes – provoking grumbles from Republicans that he had gone back on his pledge to avoid new taxes in 2002. And if Ehrlich really wants to help small businesses, he would lower the top marginal income tax rates, which apply to business income earned by sole proprietors. Why didn’t he make that pledge instead?

The State Democrats would like the media to ask Ehrlich about his law firm activities and his former protégé, RNC Chairman Michael Steele. Our advice is to ask Ehrlich to reconcile his impossible fiscal promises.

Posted by

Adam Pagnucco

at

2:00 PM

![]()

![]()

Labels: Adam Pagnucco, budget, Robert Ehrlich, taxes

Sunday, March 14, 2010

Tuesday, March 02, 2010

Leggett, Floreen Support Alcohol Tax

County Executive Ike Leggett and County Council President Nancy Floreen have written a joint letter to General Assembly leadership in support of a bill raising the alcohol tax to finance services for the developmentally disabled and other health care programs. A poll released today is the latest one to find substantial public support for the tax. Following is the letter from the County Executive and the Council President.

Posted by

Adam Pagnucco

at

2:00 PM

![]()

![]()

Labels: alcohol, Ike Leggett, Nancy Floreen, taxes

Thursday, February 18, 2010

The Alcohol Tax: Who’s Standing Up for the Disabled?

By Aaron Kaufman.

The Bill Bronrott, Verna Jones,(D-Baltimore) and Rich Madaleno alcohol tax bill (HB 832, SB 717) was introduced recently. The bill is named after the amazing disability activist Lorraine Sheehan who passed away recently. The House bill has 41 sponsors and the Senate bill has 8. These are wonderful numbers and reflect the widespread belief that the alcohol tax should be raised to support people with Developmental Disabilities and those recovering from addiction.

I believe that by declining to sponsor the legislation the following members of the Montgomery County Delegation put the desires of the alcohol lobby ahead of the vital needs of people with Developmental Disabilities:

Senators:

Kramer D-14

Garagiola D-15

King D-39

Delegates:

Kaiser D-14

Rice* D-15

Barve D-17

HellerD-19

Hixson D-20

Barkley D-39

The views of these delegation members are counter to those of the Washington Post, Baltimore Sun, Carroll County Times and Maryland Diamondback. (A person knows an idea is meritorious when college students are willing to pay more for their beer!) In addition, the alcohol tax increase is supported by 83% of Marylanders according to a recent Gonzales Research Poll. I want to extend particular kudos to Delegates Frick and Gilchrist for sponsoring the legislation because it is always difficult for freshman legislators to support legislation their committee chairman, in this case Delegate Sheila Hixson, is very much opposed to. I am especially disappointed in Delegate Kumar Barve’s decision not to sponsor the legislation. One would have hoped that he would have used his position as House Majority Leader to advocate for this legislation that benefits the most vulnerable in our society. In addition, he chairs the Ways and Means subcommittee on Revenue so one would expect that he would support a measure to bring additional revenue to the state’s depleted coffers.

Sadly, my friend Sheila Hixson remains opposed to the legislation. I hope she however will do the honorable thing and let the measure have an up or down vote this year. To do otherwise would be anti-democratic. I hope her Senate counterpart Ulysses Currie (D-25) will do the same. I urge all readers of MPW to contact their legislators to express support for this common sense legislation. HB 832/SB/717.

* Despite his opposition to the alcohol tax increase, Delegate Rice is developing a thoughtful alternative.

Posted by

Adam Pagnucco

at

7:00 PM

![]()

![]()

Labels: Aaron Kaufman, alcohol, taxes

Tuesday, January 19, 2010

The Great Choir of Happy Talk

Today, we are going to let you in on a little secret. Transportation projects are built with happy talk. Tax revenues are not necessary. What, didn’t you know? All of Annapolis knows this, and now so do you.

Why do we say this? Because this is what we hear from our leaders. We trust them, right? Our Governor announced that he wants to build a light-rail Purple Line at a cost of $1.517 billion. On the same day, the Governor announced that he wants to build a light-rail Red Line at a cost of $1.63 billion.

And of course, let’s not forget the Corridor Cities Transitway (CCT). The state has made no commitments regarding its mode and alignment, but the CCT’s Draft Environmental Impact Statement (DEIS) estimates a capital cost ranging from $450 million for bus-rapid transit to $778 million for light rail. No one is ruling out the CCT. In fact, our leaders are encouraging us to believe that we can have all three projects!

So how are we going to pay for them? Well, we are going to apply for federal money. But the three projects will have to compete with other transit lines from across the country. And the Federal Transit Administration’s approval process is arduous. But let’s assume that all this Happy Talk is correct and our three projects will beat everybody else from all over the U.S. What about the money?

The Governor said this about the Purple Line in the Gazette: “...We are assuming at least half the projected $1.5 billion cost would come from discretionary federal funds that will otherwise go to another state.” Separately, the Gazette reported that the state would have to pony up $900 million each for its share of the Red Line and the Purple Line. So for the two projects, the state’s share would range from $1.6-$1.8 billion. Half the cost of the CCT would add $225-389 million. What does that mean for taxpayers?

Last year, the General Assembly’s Department of Legislative Services calculated that a one-cent increase in the gas tax would raise about $30 million per year in revenue. Now none of the three transit lines will be built overnight. Let’s be generous and assume that the cost of any of them would be spread over the entire six-year horizon of the state’s Consolidated Transportation Program. That means the Red Line would cost $136-150 million per year in state money, the Purple Line would cost $126-150 million per year in state money and the CCT would cost $38-65 million per year in state money. Those amounts are not laying around in the state’s already-depleted Transportation Trust Fund (TTF), so they would have to be raised through new revenues. Divide all of the above amounts by $30 million – the state’s estimate of the yield of one-cent of gas tax – and the gas tax would have to go up by 4.5-5 cents for the Red Line, 4.2-5 cents for the Purple Line and 1.3-2.2 cents for the CCT.

But there’s more. The rest of the state will not simply pay more gas taxes for the sole benefit of the four jurisdictions served by these three transit projects (Baltimore City and Baltimore, Montgomery and Prince George’s Counties). If there is any revenue hike, the other jurisdictions will demand money for their priorities. It’s only fair and that is how Annapolis works. The four jurisdictions above account for about half of the state’s population. So if the rest of the state is to benefit equally from a revenue hike, the above figures would have to be doubled. If the money is raised from a gas tax hike, the tax would have to go up by 20-24.3 cents. The present gas tax, which has not changed since 1992, is 23.5 cents. In other words, to pay for the state’s share of all three transit projects plus an equal amount for the rest of the state’s transportation needs, the gas tax would have to DOUBLE.

How likely is that to happen?

During the 2007 special session, the General Assembly turned down the Governor’s proposal to index the gas tax. Instead, the legislature raised a projected $400 million per year by boosting the titling tax and devoting a portion of sales and corporate income taxes to the TTF. These changes were supposed to generate $150 million for new projects and $250 million for system preservation every year. But by November 2008, the changes were only collecting an extra $265 million per year, almost all of which was going to maintenance. In other words, the last great effort to raise more money for transportation has almost completely failed to generate ANY money for new projects.

How many legislators are serious about raising more money for transportation? Very few. Here are the only ones to sponsor or co-sponsor revenue-raising bills since the special session:

Delegate Charles Barkley (D-39) – lead and only sponsor of a 2009 bill to raise the gas tax by 10 cents. Also the lead and only sponsor of a 2009 bill to raise the gas tax by a half-cent and index it.

Delegate Bill Bronrott (D-16) – lead and only sponsor of a 2009 bill to index the gas tax.

Delegates Sheila Hixson (D-20), Jon Cardin (D-11) and Bill Frick (D-16) – co-sponsored a 2009 bill to raise the gas tax by 5 cents.

Senator Rich Madaleno (D-18) – lead and only sponsor of a 2009 bill to raise the gas tax by 5 cents and redistribute its proceeds.

That’s right, people – exactly SIX of the 188 state legislators have put their names on bills to raise more money for transportation since the special session. None of them came from Baltimore City (which would get most of the Red Line) or Prince George’s County (which would get part of the Purple Line). And none of these bills would have raised enough money to fund the state’s share of its multiple transit proposals, much less all the other worthy projects in Maryland. Meanwhile, fifteen legislators – including thirteen Republicans – co-sponsored a 2009 bill that would have cut transportation funding. Two of these legislators - Delegates Joseph Boteler (R-8) and William Frank (R-42) - represent Baltimore County, which would get four stations on the Red Line. They swim in the murkiest alligator pit of hypocrisy.

None of this matters, we are told. We can have it all – the Red Line, the Purple Line, the CCT and lots of other nice things too. Maybe there will be a little bit of a revenue hike after the election. But what happens if gas sells for $4+ per gallon in 2011? What happens if Democrats lose state seats over the issue of taxes and the economy? What happens if President Obama’s numbers are down further and Democrats suffer massive losses in Congress? What then? The Lords of Annapolis don’t want us to ask these questions. It’s not real nice of us to do so.

And so in the Great Choir of Happy Talk, nearly all of the state politicians of both parties and all regions are singing along. Happy talk buys what revenue increases will not. Everyone inside Annapolis wins.

Everyone outside Annapolis loses.

Posted by

Adam Pagnucco

at

2:00 PM

![]()

![]()

Labels: Adam Pagnucco, CCT, purple line, Red Line, taxes, transportation

Thursday, January 14, 2010

Can Teacher Pensions be Fixed? Part Four

Interest is growing in Annapolis in sending teacher pensions down to the counties. Manno’s bill offers a way out. But we are very cautious about predicting a happy end to this problem. Here’s why.

1. Target MoCo.

Is there anything easier to do in Annapolis than target MoCo? Our delegation has just two Committee Chairs and is packed with freshmen. Our County Executive does not have nearly the sway in the state’s capital that his predecessor had. And the county receives NO sympathy from any other part of the state. “You guys come across as a bunch of whiners,” says one high-ranking Annapolis source. The ICC is the one MoCo project that will be subsidized by the rest of the state through toll revenue transfers, and boy are they howling about it. Who cares when we howl about paying billions for Baltimore’s broken and convict-headed city government?

The only chance our delegation has at preventing a pension handoff is to emphasize its disastrous effects on the rest of the state. Here are the top ten beneficiaries of the subsidy in per-pupil terms in FY 2010.

1. Worcester: $1,134

2. Montgomery: $1,097

3. Kent: $1,050

4. Howard: $1,048

5. Somerset: $1,002

6. Baltimore City: $969

7. Prince George’s: $943

8. Allegany: $936

9. Garrett: $918

10. Calvert: $909

State Average: $931

2. Opposition from the business community.

Even if you are a tool-wielding proletarian, you should have sympathy for Maryland’s besieged business community. They have been clobbered again and again in Annapolis. The 2007 special session raised the top income tax rates, raised the corporate income tax and brought the hated computer tax. In 2008, the computer tax was replaced by the millionaire tax. Later that same year, transportation spending was slashed and the state’s tax competitiveness ranking dropped from 24th to 45th. And now there is talk of combined reporting and a permanent millionaire tax. Do the business lobbyists get paid enough to put up with all this?

Manno’s bill would stick the business community with the tab for teacher pensions. Business will reply, “It’s not our fault. The state screwed up its pension funds, not us. And you guys supposedly want to create more jobs, but where are they going to come from with new taxes?” One of our spies in the business community comments acidly, “I think they believe there is a jobs fairy.”

If the state employee unions get on board with Manno’s idea, there will be a titanic lobbying battle pitting labor against business. But it may not come to that. If the General Assembly decides to keep teacher pensions at the state level, they will choose the path of least resistance to finance them. Business will fight hard and perhaps avoid the guillotine, though some business taxes will surely pass. The ultimate targets will be the ones who are least aware of what is going on. As House Majority Leader Kumar Barve once told us, “In politics, when something unpleasant has to be done, it’s usually done to whoever squirms around the least!”

3. The chaotic nature of legislation.

In his comment above, Barve was referring to the genesis of the 2007 special session’s computer tax. The special session is not a desirable model for the inevitable 2011 deficit reduction package, but it is a very likely predictor of what will happen next time. Just as in 2007, the Governor’s staff will prepare a plan. Unlike in 2007, the Governor will not travel the state to sell it because no one talks about tax increases when running for re-election. In 2011, lots of freshmen will be serving in their first session. They will have no idea what is going on and will be easy prey for leadership and bureaucrats. Then the lobbyists will swarm in, ideas will be discarded as soon as they are created and chaos will ensue. The final result will bear no resemblance to sound public policy, but will be the easiest “fix” that can get to the Governor’s desk. We find nothing encouraging in such a scenario, but that is the way of Annapolis.

Manno’s bill is a sincere and intellectually honest effort to remedy the problems of the state’s pension system – problems which the state largely brought upon itself. Those who oppose his bill must either identify alternate revenues to pay for pensions or admit that county taxpayers will be on the hook when they are passed down. For us, honesty counts in government. Let’s see how much of it can be found outside Roger Manno’s office door.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, Can Teacher Pensions be Fixed, Roger Manno, taxes, Teacher Pensions

Wednesday, January 13, 2010

Can Teacher Pensions be Fixed? Part Three

Delegate Roger Manno (D-19) has proposed a bill to use revenues from a permanent millionaire tax and combined reporting to support the state’s beleaguered teacher and employee pension funds. Yesterday, we looked at whether those revenues would suffice and whether the state would suffer a competitive hit from new business taxes. Today we’ll examine a few more questions.

3. What happens to the General Fund?

Maryland’s General Fund is in big trouble. The last fiscal update projects General Fund deficits of $2 billion or more through FY 2015, with no estimate of what could be some ugly out years. We predict that the General Assembly will continue to use band-aids on the budget in 2010, but come back for a big tax hike in 2011. Manno’s plan would interfere in that effort in two ways.

First, Manno would get rid of the “Corridor Funding” method used by the state to calculate its required annual pension fund contributions. The State Retirement and Pension System (SRPS) described Corridor Funding this way in its 2009 Financial Report. In the 2001 legislative session, the Legislature changed the method used to fund the two largest Systems of the MD SRPS: the Teachers Combined System and the State portion of the Employees Combined System to a corridor method. Under this funding approach, the State appropriation is fixed at the June 30, 2000 valuation rate as long as the actuarial funded status of these Systems remains in a corridor of 90% funded to 110% funded. Once the ratio falls outside this corridor, the appropriated rate will be adjusted one-fifth of the way toward the underlying actuarially calculated rate…

Corridor Funding has been a disaster for employee pensions because it has allowed the state to systematically lowball its contributions. Prior to its adoption, the pension system had a 98.3% funding ratio in FY 2001. By FY 2007, the funding ratio had fallen to 80.4%. Bear in mind that the Standard & Poor’s 500 Index rose by 20% over this period, so the state lost a golden opportunity to capitalize on the stock market. Because of the continuous underfunding created by Corridor Funding, SRPS estimates that the state’s FY 2011 contributions will be 30% less than justified by actuarial requirements.

Under the present circumstances, the corridor method results in contributions that are less than those determined actuarially. We recommend a return to full actuarial funding at the earliest possible time.

Manno’s junking of Corridor Funding means that the state would be paying more to adequately fund its pension promises. But that means the money will not be available to pay off the General Fund deficit.

Second, if the Lords of Annapolis do go for a big tax hike in 2011, a permanent millionaire tax and combined reporting could very well be part of the package. The state needs those revenues for its General Fund, but Manno would dedicate them to pensions. If something like Manno’s proposal passes, the state would have to look elsewhere for tax increases.

4. How do tax options compare between the state and the counties?

Advocates for passing down teacher pensions to the counties argue that they have an unsustainable impact on the state budget. But we won’t let them masquerade as fiscal conservatives, because if they do go to the counties, those jurisdictions will inevitably raise their own taxes to pay for their new costs. Cutting benefits is probably not an option given the fact that the state recently hiked teacher pension benefits – a measure signed by Republican Governor Bob Ehrlich. In any event, no one is talking about giving the counties any input over benefit levels.

What tax options are available to the counties? A recent state financial report shows that the counties derived 41% of their revenues from two sources in FY 2007: property taxes (23.7%) and income taxes (17.6%). But that is misleading because those revenues include state and federal aid. In terms of locally-generated revenues alone, property and income taxes accounted for 62.3% of county receipts.

The distinguishing characteristic of both of these revenues is that they are broad-based. Property tax rates are not allowed to vary between residential and commercial properties. County income taxes use flat rates that cannot exceed a maximum rate of 3.2%. Three counties – Montgomery, Prince George’s and Howard – are already at that cap. Seven more jurisdictions - Allegany, Carroll, Harford, St. Mary’s, Somerset, Wicomico and Baltimore City – are at 3.0% or higher. That means the majority of the state’s residents live in jurisdictions that have little or no room to raise income taxes. So if pensions come down to the counties, property taxes will go up.

The state’s General Fund revenues are heavily dependent on income taxes (which accounted for 50.2% of FY 2009 revenues) and sales taxes (28.1%). But the state has much more freedom than the counties in targeting those taxes. The state can establish any income tax brackets it likes, while the counties must charge flat rates. The state can establish separate sales tax rates for many different products, including services, while the counties cannot levy general sales taxes. Our point is that if teacher pensions are sent down to the counties, they will be financed with broad-based taxes like property levies. But if teacher pensions stay at the state level, they can be financed with targeted taxes according to the whims of the General Assembly. That may be good or bad, but it is an important distinction.

5. What is in Montgomery County’s interest?

One of the arguments made against the millionaire tax was that it was bad for Montgomery County because most millionaires lived there. Combined reporting may also disproportionately target Montgomery County because it leads the state in business income. But Manno’s proposal may still be better for the county than the alternative.

Why? Montgomery benefits more in absolute terms than any other county from the state’s assumption of teacher pensions, getting a $150 million subsidy in FY 2010. Montgomery’s subsidy equaled $1,097 per pupil, trailing only Worcester County ($1,134). So using a permanent millionaire tax and combined reporting to pay for teacher pensions amounts to using Montgomery-focused revenues to pay for Montgomery-focused benefits.

The alternative is simple. The state could institute a millionaire tax and combined reporting to pay for its General Fund deficit while at the same time handing down pension costs to the counties. The pension handoff could even be wealth-adjusted, impacting Montgomery even more. This would be the equivalent of a simultaneous head shot, body punch and low blow on the Economic Engine of Maryland.

We’ll wrap this up tomorrow.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, budget, Can Teacher Pensions be Fixed, Roger Manno, taxes, Teacher Pensions

Tuesday, January 12, 2010

Can Teacher Pensions be Fixed? Part Two

Delegate Roger Manno (D-19) has introduced a bill that would keep teacher pensions at the state level, but pay for them with an extension of the millionaire tax and combined reporting for corporations. That strategy creates a cascade of budgetary and economic questions that goes far beyond the pension system itself. We’ll begin asking those questions today.

1. Are the millionaire tax and combined reporting enough to pay for pension cost increases?

The state’s October Spending Affordability Briefing reports that to maintain solvency of the teacher pension fund, the state must increase its contribution from $676 million in FY 2009 to $928 million in FY 2011 – a $252 million increase in just two years. The employee pension fund, which would also benefit from the new revenues recommended by Manno, must have its contributions increased from $258 million in FY 2009 to $393 million in FY 2011 – a $138 million increase. The briefing is silent on additional increases in the out years, but they are sure to be substantial.

Manno’s bill has no fiscal note yet, so we will have to rely on other sources to calculate the additional revenues raised by a millionaire tax extension and combined reporting. The millionaire tax, which in its current form is actually a three-year surcharge starting in Tax Year 2008, was estimated to raise a peak annual amount of $154.6 million in FY 2009 with declining amounts thereafter. The drop in the number of Free State millionaires, caused almost entirely by the recession, suggests that the tax raised substantially less than projected. And while only about 2% of the state’s millionaires have moved out because of the surcharge, many more could leave – and many more could never move in – if the tax was made permanent. However much a permanent tax might collect, what is clear is that it is a VERY volatile source of revenue. And the pension system needs a reliable and increasing source of contributions.

As for combined reporting, the Comptroller’s Office recently estimated that the state would have collected an additional $109-170 million in tax year 2006 if combined reporting had been in place. But the Maryland Chamber of Commerce noted:Tax year 2006 represented the highest level of corporate income taxes ever collected by the state ($868 million) during a robust economy. What would be the impact of combined reporting during the current recession when millions in tax losses could be imported into the state from out of state entities?

Moreover, if combined reporting did raise a large amount of money soon after its enactment, business would not sit still and simply absorb the losses. It makes sense that at least some of them would restructure their operations to adapt to combined reporting and minimize their tax liabilities. Some who could not sufficiently adapt might move out. So combined reporting could collect less over time. Further, corporate income is almost as volatile as top-level income tax revenue, generating more questions about contribution volatility in the pension system.

Based on the above, we believe that a permanent millionaire tax and combined reporting together could well generate tens, or perhaps even a hundred million dollars or more per year. But their tendency to experience huge swings with the business cycle suggests that more stable revenues need to be found to augment them to keep the pension system’s funding ratio from swinging like a pendulum.

2. What about the state’s tax competitiveness?

In considering any new taxes on business or the wealthy, policy makers must consider the consequences for the state’s ability to retain and attract jobs. Maryland could use some help on that score. From 1998 to 2008, Maryland added 272,600 jobs, an 11.7% growth rate, according to the Bureau of Labor Statistics. Over the same period, Virginia added 437,500 jobs, a 13.2% growth rate and D.C. added 91,300 jobs, a 14.9% growth rate. Maryland’s seasonally adjusted employment in October was 2,533,700, a decline of 3.1% from its all-time high of 2,616,000 in February 2008. Maryland’s seasonally adjusted unemployment rate has exceeded 7.0% for seven months starting in May 2009, the first time that has happened since 1983.

The 2007 special session’s tax increases for high income earners and corporations caused Maryland’s tax competitiveness to fall from 24th to 45th among U.S. states according to the Tax Foundation. Maryland remains at 45th in their latest survey. The principal reason for Maryland’s low ranking is its top income tax rate, which the Tax Foundation believes discourages entrepreneurship. Here’s how Maryland’s top rate compares to neighboring states.

Pennsylvania: 3.07% flat rate

Virginia: 5.75% over $17,000

Maryland: 6.25% over $1 million

West Virginia: 6.5% over $60,000

Delaware: 6.95% over $60,000

District of Columbia: 8.5% over $40,000

D.C.’s rate is not a fair comparison since the District government performs the functions of both a state and a local government.

Take away Maryland’s millionaire tax and it performs slightly better against Virginia. While Virginia charges 5.75% on income over $17,000, Maryland charges 4.75% on income between $3,000 and $150,000 and rates varying from 5% to 5.5% after that. But Virginia does not allow its counties to levy income taxes. Maryland does, and its counties can charge up to 3.2% as a flat income tax rate.

Here’s how taxes compare across several jurisdictions in the Washington D.C. area.

Like it or not, Maryland is in tight competition with Virginia and other surrounding states for jobs. Will retention of the millionaire tax have an employment cost over the long run? Furthermore, Delaware, Pennsylvania and Virginia do not have combined reporting. If Maryland enacts it, will those states get a competitive advantage?

We do not have the answers to these questions yet. But they should be answered before Maryland considers imposing a permanent millionaire tax or combined reporting. The latter issue is one of many now being examined by a commission established during the special session.

We’ll look at some more questions tomorrow.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, Can Teacher Pensions be Fixed, Roger Manno, taxes, Teacher Pensions

Monday, January 11, 2010

Can Teacher Pensions be Fixed? Part One (Updated)

Delegate Roger Manno (D-19) has proposed an ambitious plan to fix the state’s troubled teacher pension program as well as to prevent pension liabilities from getting passed down to the counties. But his remedy is sure to provoke big questions about tax competitiveness, equity and general fund deficit solutions, as well as to possibly pit two of the state’s most powerful lobbies against each other.

Maryland’s State Retirement and Pension System (SRPS) administers five defined benefit pension systems: teachers (106,107 participants on 6/30/09), government employees (89,448), law enforcement officers (2,445), state police (1,408) and judges (297). The five systems together had $34.3 billion in assets and $51.4 billion in liabilities in FY 2009, meaning that they were unfunded by $17.1 billion. The unfunded liability increased by $6.4 billion in just one year and the system is now only 65% funded. The employees covered by these plans are mostly state workers with the notable exception of teachers and other school employees. Counties negotiate contracts with the school employees, and the promised pension benefits – which are tied by formula to county-set compensation – are paid by the state. Some state politicians – notably Senate President Mike “Big Daddy” Miller - would like to see the counties pick up at least part of the cost of the teacher pensions.

In FY 2010, the jurisdictions that most benefitted from the state’s assumption of teacher pensions were Montgomery ($150 million in state-assumed costs), Prince George’s ($114 million), Baltimore County ($86 million), Baltimore City ($74 million) and Anne Arundel ($63 million). But in per pupil terms, the biggest beneficiaries were Worcester ($1,134 per pupil), Montgomery ($1,097), Kent ($1,050), Howard ($1,048) and Somerset ($1,002). We show all of these costs below.

In the 2009 general session, the Senate President introduced a bill that would have phased in county financing of teacher pensions over four years. The bill would have imposed more than a billion dollars in costs on the counties over the first four years and more than half a billion dollars every year thereafter.

Preventing a handoff of teacher pensions is a top priority for Montgomery County. Assuming that liability would devastate the county’s already-depleted budget. County Executive Ike Leggett memorably told Miller a year ago that he was drawing “a line in the sand” over teacher pensions. Montgomery House Delegation Chair Brian Feldman backed him up, saying, “This is one area, perhaps our highest priority, to make sure there aren’t changes made to the current system.” But Miller laughed it off, chuckling, “My good friend Ike Leggett said that he’s going to draw a line in the sand… You never want to draw a line in the sand. Believe me, because I’ve had to rub out many of them in my lifetime, and I’m going to help him rub that one out as well.” Montgomery should beware, because if anyone gets the last laugh in Annapolis, it’s usually Big Daddy!