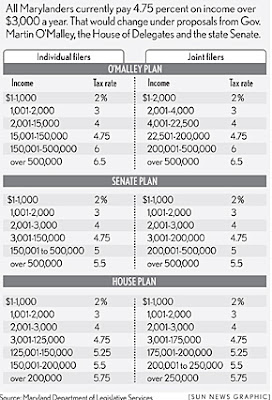

The Baltimore Sun produced the above chart showing the three income tax plans currently on offer from Gov. O'Malley, the Senate, and the House. While the differences between the House and the Senate plans seem relatively small to me, reconciling them may not be so easy. Montgomery senators do not appear unified on this question:

The Baltimore Sun produced the above chart showing the three income tax plans currently on offer from Gov. O'Malley, the Senate, and the House. While the differences between the House and the Senate plans seem relatively small to me, reconciling them may not be so easy. Montgomery senators do not appear unified on this question:

Most of the Montgomery County senators who voted in favor of that chamber's tax bill last week said the House version hits upper-income taxpayers too hard, although the House did not go as far as Gov. Martin O'Malley.Combined reporting also remains an issue though that appears likely to be resolved in favor of the House's plan to close the loophole:

Sen. Jennie M. Forehand, a Montgomery County Democrat, said she did not think the top income-tax bracket, for those with incomes more than $500,000 a year, should be higher than 5.5 percent.

"My district has a lot of high-tech, biotech companies that are expanding and trying to recruit some of the top scientists and business people," she said. . . .

Sens. Brian E. Frosh and Michael G. Lenett, both Montgomery County Democrats, said they prefer the House version.

"It will be a source of controversy within the Senate," Frosh said. "There are some folks, especially those from Montgomery County, who think we should take it easier on well-to-do people."

The House included "combined reporting" in its tax bill.

The House approved O'Malley's proposal to close a "loophole" - referred to as "controlling interest" - that enables some corporations to avoid recordation and transfer taxes by making their real estate part of a limited liability company.

The Senate amended the governor's plan to raise the threshold of what defines a company covered by the tax law change, changed the method of valuing property from the sale amount to the assessed value, and exempted all deals before Jan 1.

"The Senate amendments provide a substantial loophole in the effort we are trying to resolve," said Sen. Richard S. Madaleno Jr., a Montgomery County Democrat who supports the House version.

Sen. Ulysses Currie, chairman of the Budget and Taxation Committee, said he expects a compromise with the House over the personal income tax proposals and the rest of the tax package.