Today, Maryland Democrats are celebrating the reelection of Governor Martin O’Malley, U.S. Senator Barbara Mikulski and their holding onto both chambers of the General Assembly. But the reality of governance will soon set in. Why?

Because the Republicans have won control of the U.S. House of Representatives, and that means federal stimulus aid for the state government has almost certainly dried up.

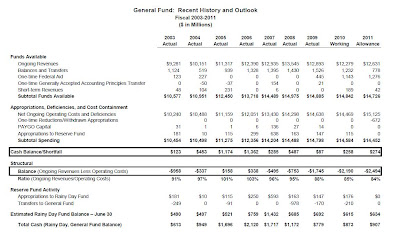

Maryland’s state government has been subsidized by federal stimulus money under ARRA (the American Recovery and Reinvestment Act of 2009) for three fiscal years: 2009, 2010 and 2011. According to the state’s latest Spending Affordability Committee report, the state government has received $4.4 billion of stimulus funding over the last three fiscal years. The largest subsidies have been directed to Medicaid ($1.6 billion), education ($1.1 billion) and infrastructure ($781 million).

The stimulus funds have been invaluable for closing Maryland’s general fund deficits. In FY 2009, 2010 and 2011, the state racked up $6.4 billion in structural general fund deficits. It has used $2.9 billion of federal stimulus money to help close those deficits. That means federal money has been used to plug almost half of Maryland’s budget gaps.

With the election of a Republican U.S. Congress, that money is gone. And Maryland faces a general fund deficit in FY 2012 that could be as high as $1.6 billion. That leaves a number of unappetizing options to deal with it.

Budget Cuts

In FY 2011, 41% of all state general fund spending was sent as aid to local governments. By spending category (which overlaps local aid), 50% of the general fund goes to education, 24% goes to health care and 9% goes to public safety. Those three items combined account for 84% of the general fund in FY 2011. It’s probably impossible to have meaningful long-term spending cuts without touching one or more of these areas.

Teacher Pensions

In the 2010 session, the Senate passed a plan to phase in a partial handoff of teacher pension obligations to the counties. The plan would have saved the state no money in FY 2011, $63 million in FY 2012, $194 million in FY 2013 and more than $300 million annually in the out years. Those out year revenues are significant, but the state’s budget problems may necessitate collection of them earlier. So the General Assembly could well choose to accelerate the phase-in and make the counties assume a greater share of the cost than in the Senate’s plan.

Diversion of Transportation Revenues

The Transportation Trust Fund (TTF) claims over $800 million a year in state funding. The TTF’s revenues include vehicle titling fees (20%), gas taxes (19%), registration fees (15%), operating revenues (10%), sales taxes (6%), corporate income taxes (4%) and more. All are ripe for diversion to the general fund. The General Assembly has already seized transportation money due to the counties so state transportation money could be next. That would be a disaster for the state’s infrastructure, but if transportation advocates are pitted against education advocates, who do you think will win?

Tax Hikes

The three most discussed taxes are an extension of the millionaire tax (which was supposed to last for three years), the imposition of combined reporting to capture more corporate income taxes and an extension of the sales tax to services. The first two options will be resisted by the business community and both have very uncertain revenue generating capabilities. The last time the state tried to extend the sales tax to services, the result was the much-hated computer tax (which was repealed in 2008).

Casting a long shadow over the taxation debate is the state’s competitive position with its neighbors – especially Virginia. The Tax Foundation’s FY 2011 tax competitiveness report ranks Delaware #8, Virginia #12, Pennsylvania #26, West Virginia #37 and Maryland #44 of the fifty states. Here is how Maryland compares to Virginia on a few tax measures.

Corporate Income Tax

Maryland: 8.25%

Virginia: 6.00%

Top Income Tax Rate

Maryland: 6.25% (at $1 million income)

Virginia: 5.75% (at $17,000 income)

Sales Tax

Maryland: 6%

Virginia: 5%

Maximum Unemployment Insurance Tax Rate

Maryland: 13.5%

Virginia: 6.2%

At least the state will not have to pay for Bob Ehrlich’s proposed $700 million sales tax cut.

Now what were we saying about celebrating?

Wednesday, November 03, 2010

Now Comes the Hard Part

Posted by

Adam Pagnucco

at

2:00 PM

![]()

![]()

Labels: Adam Pagnucco, budget, State Aid, taxes, Teacher Pensions, transportation

Thursday, October 28, 2010

Bob Ehrlich: The Anti-MoCo Candidate, Part Two

In Part One, we showed how Bob Ehrlich’s positions on transportation and the Purple Line would damage Montgomery County. Today, we examine a different set of issues that are connected to another county priority: education.

Teacher Pensions

For decades, the state government has administered and financed a pension fund for teachers and other local school employees for the purpose of attracting talented educators. The system has contributed to Maryland’s repeated Number One ranking for its public schools. But the pension fund has encountered three problems: a change to the state’s contribution formula enacted during the Glendening administration that allowed the state to lowball its payments into the fund, investment performance problems during the recent stock market crash, and a large unfunded benefit increase signed by Governor Ehrlich. The state will either have to increase its contributions to the pension fund, restructure future benefits, or both. But some in Annapolis have a different idea: pass down the funding obligations to the counties even though they did nothing to cause the problems.

The state’s assumption of teacher pensions is one of the few state programs that benefit Montgomery County. That’s because MoCo hires lots of teachers and has to pay them well to compete with the rest of the Washington area. Most of the state’s other aid programs are tied to wealth formulas that send MoCo tax dollars away to other jurisdictions. In the last session, the Senate passed a handoff plan that would have cost MoCo $192 million over four years – far more than any other county. MoCo already runs nine-digit annual budget deficits and such an additional cost would play havoc with county services.

So what of the two candidates for Governor? Ehrlich favors at least a partial shift while O’Malley is vague. We do not find O’Malley’s ambiguity comforting. But the truth is that O’Malley has had multiple opportunities to pass down pension liabilities to the counties, an idea aggressively supported by the Senate President, and he has not done so. Ehrlich’s election would certainly saddle MoCo with a gigantic pension obligation that it cannot afford, while O’Malley’s reelection would give the county a little bit of hope that we can negotiate something marginally better. On this issue, MoCo’s interest aligns with O’Malley.

Education Funding

Maryland’s Number One public schools ranking depends not only on the state’s funding of teacher pensions, but also in part on the massive amounts of state aid that go to its local school systems. Much of that school aid has its roots in the 2002 Thornton Plan, which committed the state to hundreds of millions of new dollars in school spending. Education funding is popular in Maryland, but Thornton is not just an aid program: it is also effectively a transfer program because it is driven by wealth formulas. That means the state disproportionately funds “poor” jurisdictions with money taken from “wealthy” jurisdictions.

Let’s put aside the fact that MoCo is not as rich as the state believes. Montgomery County has one-sixth of the state’s population, pays one-fifth of the state’s combined income and sales tax revenues and accounts for one-third of its business income. One would believe that the county would receive comparable benefits from the state in return. But in FY 2009, MoCo received $166 million of the state’s $2.8 billion in base education aid, or just 6% of the total. This is despite the fact that MCPS has a higher percentage of limited English students than any other jurisdiction in Maryland.

Back in 2002, when the Thornton Plan was being drafted, then-County Executive Doug Duncan and his top budget expert, future Senator Rich Madaleno, were aware that this kind of disparity would result. So they pressed the state to include a program with Thornton that would later be known as the Geographic Cost of Education Index (GCEI). The point of GCEI was to direct additional money to jurisdictions that experience higher costs of educating students. Because the program also benefited Baltimore City and Prince George’s County, it passed the legislature along with Thornton – but only as a discretionary spending item. Governor Ehrlich refused to fund it. Governor O’Malley phased in funding over his term.

GCEI is a relatively small program, even under O’Malley. It accounts for $127 million of the state’s $2.9 billion in school aid in FY 2011, of which just $31 million goes to MoCo. (Prince George’s County gets $39 million.) But Bob Ehrlich has targeted it for elimination to partially pay for his proposed sales tax cut. Ehrlich told the Associated Press that the program was “a political ploy” and that “It was all about getting votes in the 2002 session… They just made it up to get votes from Montgomery County to pass Thornton in the first place.”

Let’s be clear, Governor Ehrlich. We in Montgomery County pay more in taxes to the state than any other jurisdiction. We are entitled to ask for a fair share of state money in return. We support any effort by our delegation to fund public education and to bring back the dollars we need for MCPS. Any politician who has a problem with that does not deserve our vote.

Want more? Come back tomorrow for Part Three.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, education, GCEI, Martin O'Malley, Robert Ehrlich, State Aid, Teacher Pensions

Wednesday, March 31, 2010

Hurson Weighs in on Teacher Pensions

Hoisted from the comments: Former Delegate and House Majority Leader John Hurson (D-18) weighs in on the controversy over teacher pensions.

I hesitate to weigh in on this controversy but Adam is doing such a great job of imitating Blair Lee's usual flogging of the county's Annapolis delegation, I can't resist. Senator Madaleno's proposal on teacher pension funding may not be to the liking of many, but it was a smart move at the right time.

The teacher pension issue (Montgomery County's state share of funding tops all other jurisdictions shares) has been a Montgomery County liability in Annapolis for decades. I was a freshman delegate in 1992 when the state shifted teacher's Social Security payment responsibility to the counties. Everyone in the Montgomery County delegation strongly opposed the shift, but the legislature did it (to us!) anyway. It was not pleasant. The teacher pension issue has been sitting there ready for the same treatment for over two decades.

Senator Madaleno knows a train wreck when he sees it coming, and the inevitable shift to local jurisdictions of these costs was coming. The only question was "how" it was going to be done. By getting out ahead of this change and managing it's implementation he has done a very difficult, but important thing for the county.

Sure, we would all like to believe that somehow ( persuasion, pressure, mutual friends) we could avoid this change. Yes, there is alot of deception and delusion in Annapolis. But believing this change was not going to happen is self delusion and would get us right to where we were on the shift to the locals of teacher Social Security payments in 1992--embarrassed, isolated and paying for it anyway under implementation conditions that were very difficult for the county. Senator Madaleno has managed to gain leverage for the county by his proposal, and has put us at the table as the plan gets drafted. In Annapolis, we call that leadership.

Posted by

David Lublin

at

3:00 PM

![]()

![]()

Labels: budget, John Hurson, Rich Madaleno, Teacher Pensions

Tuesday, March 30, 2010

Pension Surprise Wrong for Montgomery County

By Patricia B. O’Neill, President, Montgomery County Board of Education.

Last week, in a surprising move, the Maryland Senate voted to transfer hundreds of millions in teacher pension costs from the state to local governments out of concern that the expenditure is unsustainable. As president of the Montgomery County Board of Education, I must say that this was a total surprise to us, especially given that the move was championed by one of our own legislators, Senator Rich Madaleno. It is comforting for now that the proposal appears to have stalled, with the House Appropriations Committee recommending a study of the implications of the cost shift. It is the right and respectful thing to do, and Delegate Norman Conway, chair of the committee, is right; a seismic shift of this magnitude should only be undertaken after a comprehensive study involving all stakeholders. At the very least, those who are going to be affected adversely by this shift should have been aware of this instead of reading about it in the papers and blogs.

This is nothing personal against Senator Madaleno. Here in Montgomery County, we love and respect Senator Madaleno. He is usually a trusted ally who fearlessly goes to bat for Montgomery County using his intellect, charm, and boundless energy. It was, therefore, a stunning shocker when we on the Montgomery County Board of Education learned, without any prior warning, that he had introduced legislation that would shift in yearly installments the obligation for teacher pensions to local jurisdictions. We wish he had spoken to us before hand. If this legislation passes, it will be hard to find in the history of Montgomery County a more devastating fiscal blow delivered by one of our very own. There is no one that I have spoken to that understands why Senator Madaleno chose to lead this fight that could in essence jeopardize the retirement income of the teachers and staff of Montgomery County Public Schools.

Senator Madaleno has tried to explain why he decided to sponsor a plan to shift these funds from the state to the local jurisdictions. It is very simple, he says, the system in its current form is unsustainable. If this is correct, then, it is puzzling how merely shifting the burden to counties solves the problems. The only explanation would be that the proposed legislation is a Trojan horse carefully designed to force a conclusion to Madaleno’s thesis – that the pension plan for our hard working teachers and staff is unaffordable and unsustainable. Let’s be clear — the cost to Montgomery County of the Madaleno-inspired shifts would be staggering, and in this climate quite simply unaffordable. Senate staffers have calculated that it would cost us $13 million in FY 2012, $41 million in FY 2013, $69 million in FY 2014, and $70 million in FY 2015. Let’s also be clear — if this bill passes, the options are limited and unpalatable. These are funds that would be competing with other needs. If taxes are not raised, our staff would be forced to absorb the expenses through reduced pensions or vastly increased employee contributions to the pension fund. These cuts, if passed on to Montgomery County Public Schools (MCPS), would be devastating. The effect would be to decimate our instructional program as we know it today. These cuts could represent losses of hundreds of teachers; as many as 140 in FY 2012, 440 in FY 2013, 740 in FY 2014, and 751 in FY 2015. The county is already reeling from the effects of a global recession, and the Board of Education has been working closely with the County Executive, County Council, and our unions to brave a very tough fiscal climate, beginning with this year when our unions agreed to forgo $79 million in raises in order to close the fiscal gap.

For next year, the school system has had to accept an unprecedented $137.7 million in additional cuts. As we struggle with these cuts, we are doing everything in our power to avoid cutting those investments that have made a difference in the lives of our youngsters. I have been on the Board of Education for more than ten years and I have not seen anything quite like this. In all of this financial tsunami, I have been impressed with the cool-headed approach of the leadership of all our unions representing our teachers, support staff, and administrators. They have shown a great willingness to work with us through these issues. The timing of this legislation couldn’t have been more inappropriate. I call upon Senator Madaleno and all our representatives in the name of all that is fair and decent to fight this pension shift. It could have devastating consequences to our teachers and staff. Beyond the fiscal cost, the loss in morale for staff that is faced with forgoing any salary increases again next year is incalculable. We have always prided ourselves on ensuring that the best and committed are retained in our classrooms. This we do by compensating them fairly and ensuring that their wages and classroom preparedness are on par if not superior to neighboring jurisdictions. This proposal is a giant step backwards in that regard. Our teachers and staff deserve better than this.

Finally, I believe that any attempt to compromise what our teachers and staff have earned in terms of their retirement is, quite simply, morally wrong. The pension plans for MCPS employees have been unfairly compared to those of employees in the private sector. When most employees in the private sector were investing their defined contributions in the financial markets, our employees were earning the same in the form of defined benefits that they would need in their retirement years. Our employees did not have the flexibility of investing these funds themselves and presumably making a substantial profit. By working in our classrooms, they chose a conservative option of earning their benefits over the years. What Senator Madaleno’s proposal does ironically is to put at great risk the earned fruits of the hard labor of the incredibly dedicated men and women that toil daily to secure the future of our children. That is just not right. The economic challenges that we face today are not for a single individual to bear alone. As elected officials, we are a team sworn to protect the interests and the future of our citizens. A key part of that problem solving is communication and dialogue. What just happened is a sobering commentary on how we conduct business – in silos, with little connections to each other. As President of the Montgomery County Board of Education, I pledge on behalf of the Board that I will work alongside all key players to ensure that our delegation in Annapolis fights for and represents our interests. These times that we live in call for nothing less.

Posted by

Adam Pagnucco

at

12:00 PM

![]()

![]()

Labels: Board of Education, Pat O’Neill, Rich Madaleno, Teacher Pensions

Monday, March 29, 2010

MCEA Condemns Teacher Pension Shift

Following is a press release from MCEA opposing the shift in teacher pensions that was passed by the Senate. The release contains some pointed language directed at Senator Rich Madaleno (D-18), who authored the proposal and has been known as one of MCEA's best friends over the years.

March 29, 2010

FOR IMMEDIATE RELEASE

FOR MORE INFORMATION CONTACT: Doug Prouty 301-294-6232

MCEA Condemns Effort to Shift State Pension Costs onto Counties Calls on County Delegates to Oppose Proposal

The Montgomery County teachers union today decried the last minute maneuver in the State Senate to shift hundreds of millions of dollars in state pension costs onto local counties. The union is mounting an intensive grassroots lobbying effort to convince Montgomery County delegates to the General Assembly to oppose the proposal.

“There is no other issue that unites everyone in Montgomery County as much as opposition to the shift in pension costs,” said Doug Prouty, President of the Montgomery County Education Association (MCEA). “Liberal or conservative, Democrat or Republican, pro-business or pro-labor, MCPS advocate or MCPS critic – everyone understands that shifting pension costs has a disproportionate impact on Montgomery County.” The pension funding formula is the only state aid program that favors Montgomery County.

The Senate proposal would shift $13 million in state pension costs onto Montgomery County in FY12, with the amount growing to $70 million a year by FY15. Seven of Montgomery County’s eight state senators voted against the proposal.

Prouty questioned why Kensington State Senator Richard Madaleno sponsored this proposal. “Rich Madaleno has been a stellar advocate both for our county and our schools,” Prouty said. “Rich may think that this is the best deal that Montgomery County can get and that he is doing the right thing, but if he can’t convince the rest of the political leadership of the county, he has no right to cut this deal on his own. Rich has overstepped on this, and it’s a shame.”

Prouty pointed out that the proposal is being rammed through at the last minute. The amendment surfaced for the first time last Thursday. It was voted out of committee on Friday, and passed the full Senate on Tuesday. Governor O’Malley had not included the pension shift in his proposed budget, and there had been no proposal to do so during the first eight weeks of the legislative session.

The state government controls the benefit levels in the pension plan. The state government controls the investments of the pension funds. Prouty says it makes no sense to require counties to pay pension costs for a pension plan they do not control.

“The amazing thing,” Prouty continued “is that this does nothing to improve the long-term financial health of the pension plan. We are committed to working with the state to ensure that the pension fund is stable. All this proposal does is pass the buck back to the counties while ignoring the need to improve the long-term health of the state pension plan.”

# # #

Posted by

Adam Pagnucco

at

4:00 PM

![]()

![]()

Labels: Doug Prouty, MCEA, Rich Madaleno, Teacher Pensions

Friday, March 26, 2010

Rich Madaleno on Teacher Pensions

Over the past week, the Senate completed its work on the state budget for the fiscal year that starts July 1, 2010. The budget plan is now being deliberated by the House of Delegates. The plan adopted by the Senate includes $2 billion worth of cuts and transfers, including, as you know, a plan to revise the way the employer obligation for teacher pensions is funded beginning in Fiscal Year 2012. Under this plan, roughly one third of the obligation would be shifted to the counties. While this is a change in a longstanding policy, let me explain why I helped draft this compromise which will balance the needs of our county and our state.

As this point, most people are aware of the unprecedented impact the recession has had on our state's finances. Revenues are five percent lower this year than last year - easily the worst drop in revenues since the Depression. Even the state's current optimistic revenue projections – which anticipate a robust economic recovery happening sooner than what now seems likely – anticipate a gap of $2 billion, or 15% of planned expenditures, for each of the next four years.

During the next four years, state funding for teacher pensions will nearly double to $1.25 billion. That is a devastatingly large sum. That’s more than the entire amount the state will be spending for our public universities and colleges. In fact, that one expense will account for roughly one-quarter of our projected four year deficit.

Even if we were to raise taxes substantially – a political impossibility in Annapolis during the current political climate – we couldn’t cover these costs. We could raise the state sales tax by 1%, repeal the Glendening 10% income tax cuts, maintain the “millionaire’s tax,” and institute combined reporting for the corporate income tax - and we still wouldn’t have enough money to cover our forecast deficit.

Our current approach to spending is simply not sustainable.

For several years, some of my colleagues have been determined to change our approach to funding teacher pensions, and several proposals were floated again this year. Adoption of any one of them would have been disastrous for Montgomery County.

o The first would have transferred fully one half of the cost of pensions immediately - forcing the counties to instantly swallow $450 million in new costs, an untenable situation for any county including Montgomery.

o The second would have transferred to counties the responsibility of funding the pension contribution for all new hires and pay increases - a proposal that would have eventually shifted 100% of pension costs to the counties.

o The third proposal would have made the counties responsible for all contributions in excess of the FY07 salary base. While this option would have required a similar initial contribution from counties, costs to Montgomery County would balloon over time, placing severe, ongoing, and crippling limitations on county finances.

Some have argued that our county's delegation should refuse to accept any shifting of teacher retirement costs on to county governments. That sounds great, but unfortunately, recent history shows that this approach not only does not work, it has devastating results. During the much less painful 1992 recession, Montgomery County refused to accept any shifting of teacher retirement costs on to county governments. Not a single county legislator participated in crafting the final plan. Nor did any vote for it. But Montgomery County doesn’t control a majority of seats in the General Assembly – not even close. So against our county’s united opposition, the rest of the legislature and the governor simply ignored us: the state shifted the entire cost of social security as well as the pension cost for two years on to Montgomery County, effective immediately. Our county is still paying the price for taking what seemed to be a principled stand and not having a seat at the table.

It is essential for Montgomery County to have a seat at the table if we want to look after our interests. In fact, earlier this month, it became clear that the third of the above proposals – the one with severe negative long-term consequences for Montgomery County – had sufficient votes to pass this year. So I was determined to develop a counter-proposal that would reduce the unavoidable impact on Montgomery County.

The Senate Budget and Taxation Committee's proposed legislation, unlike the one in 1992, delays implementation of the cost-sharing by a year. It also phases the cost-sharing in gradually over three years, thus allowing time for counties to plan. In the end, the counties' contribution rate will be less than one-third of the total pension obligation. In addition, the county rate will adjust downward as the health of the pension trust fund improves. Under this plan, Montgomery County remains the largest beneficiary of state dollars for teacher pensions.

Sometimes as a legislator, one is faced with a series of unattractive choices. This pension plan passed the budget committee by a vote of 12 to 3. By my estimation, it would not have been responsible to sit back and watch a far worse deal pass by a vote of 11-4, with Montgomery County’s senators united – and almost alone – in their opposition. I did not want to see us get rolled again. On this one, I decided to engage in the hope of shaping a more favorable outcome for Montgomery County.

The Senate President commented that he did not anticipate the House passing the pension plan. I expect this issue to be assigned to study during the interim, and I hope it will serve as a "ceiling" for what a cost sharing approach might look like. I will continue to look at ways we can protect our commitment to a dignified retirement for teachers while balancing the competing and equally compelling needs of our state. Difficult choices lie ahead, and I hope my actions show that I am willing to take whatever means are necessary to ensure that Montgomery County contributes to the discussion and is not left on the sidelines holding the bag.

Sincerely,

Richard S. Madaleno, Jr.

Posted by

David Lublin

at

2:53 PM

![]()

![]()

Labels: budget, General Assembly, Rich Madaleno, Teacher Pensions

Thursday, March 25, 2010

Madaleno: “Dire Financial Straits” Justify Teacher Pension Handoff

News Channel 8's Bruce DePuyt interviewed Senator Rich Madaleno (D-18) about his plan to shift teacher pension obligations to the counties. Among Madaleno's reasons for characterizing teacher pensions as unaffordable is the 2006 pension benefit increase lobbied for by the teachers union and signed by Governor Bob Ehrlich. Madaleno contrasts the cost of paying for teacher pensions to the cost of paying for services for the developmentally disabled. DePuyt also asks Madaleno if Senate President Mike "Big Daddy" Miller put him up to this - a subject of rampant speculation among our sources. The video of DePuyt's interview with Madaleno can be seen for a short period of time on this page.

Posted by

Adam Pagnucco

at

9:00 PM

![]()

![]()

Labels: Rich Madaleno, Teacher Pensions

Wednesday, March 24, 2010

What We Learned from the Senate’s Teacher Pension Vote

The Senate’s passage of a partial handoff of teacher pensions to the counties last night – a proposal crafted by none other than MoCo Senate Delegation Chairman Rich Madaleno – contains quite a number of lessons for students of Annapolis. Here is what we learned.

1. Many Senators will vote against their own constituents on this issue.

Eight jurisdictions receive more than the FY 2010 average of $931 per pupil as a benefit from this program. They are:

1. Worcester: $1,134

2. Montgomery: $1,097

3. Kent: $1,050

4. Howard: $1,048

5. Somerset: $1,002

6. Baltimore City: $969

7. Prince George’s: $943

8. Allegany: $936

Sixteen Senators represent parts of Montgomery and Prince George’s Counties. They voted 13-3 against the handoff, with only Madaleno, Budget and Taxation Committee Chairman Ulysses Currie and Senate President Mike “Big Daddy” Miller supporting it. Twelve Senators represent the other jurisdictions. They voted 11-1 in favor, with only Baltimore City Senator Lisa Gladden voting against. All three Howard Senators – Republican Allan Kittleman and Democrats Ed Kasemeyer and Jim Robey – voted in favor of the handoff. All three know that the county’s likely response to assuming the handoff will be to raise taxes. Robey, a former Howard County Executive, knows that better than anyone.

2. The Republicans are not unified.

GOP Senators voted 10-4 in favor of a handoff. Arguably the two most conservative Senators – Alex Mooney and Andy Harris – voted against it. Perhaps they agree with GOP House Minority Leader Tony O’Donnell, who says that shifting pension costs “almost guarantees the locals are going to raise your taxes.” O’Donnell is absolutely right. One possibility under discussion is that a future pension handoff be accompanied by allowing the counties to raise their income tax rates beyond the current cap of 3.2% to pay for it. Is that an idea that deserves support from the GOP?

3. Miller benefits from Currie’s weakness.

Two years ago, there was speculation that Currie’s legal problems would cause difficulty for Miller. In fact, the opposite has happened. Miller kept Currie in his Chair through all of his travails and they appear to have blown over. So while Currie has always been dependent on Big Daddy, he now owes everything to him – ensuring Miller absolute control over all budgetary issues. If Delegate Aisha Braveboy challenges Currie, she will be sure to point out how Currie voted against the interests of Prince George’s voters at Miller’s direction.

4. The teachers’ clout in Annapolis is over-rated.

Financing teacher pensions is one of the highest priorities for the state teachers, who fought hard to get a benefit hike back in 2006. They were either caught napping or reacted with docility to the Senate’s lightning-quick passage of a handoff. This follows their getting played by Governor O’Malley, who supported the backdoor-voucher BOAST bill shortly after the teachers gave him an early endorsement.

5. Rich Madaleno has taken a hit.

Madaleno drafted the pension handoff and was its floor leader last night. Joining him in speaking for it were Baltimore City Senator Nathaniel McFadden, GOP Minority Leader Allan Kittleman and former GOP Minority Leader David Brinkley. The spectacle of MoCo’s Senate Chairman teaming up with Big Daddy, Baltimore and the Republican leaders to erode a rare program that benefits Montgomery was too much for some of the county’s politicians to take.

“People here are talking about Rich throwing MoCo under the bus,” said one. Another official ranted, “Rich sold MoCo out, pure and simple. I am sick to my stomach.” A third person said, “Not sure what passing pension shift does from negotiating standpoint for our County. Does not look good to have Chairman of Delegation leading effort to have Montgomery County pick up 20% of the tab on pension shift.” Yet another said, “I wonder if Rich may be suffering from Stockholm Syndrome since he is basically a hostage to Miller and spends all day every day with Miller’s tightest cronies on the Budget and Tax Committee.” Madaleno did not attract a single vote from the MoCo delegation for his proposal, not from the liberal Brian Frosh, not from the conservative Rona Kramer, and not from anyone else in between.

Our informants do not expect the House to pass the Senate plan, but teacher pensions are sure to be raised next year. If so, the logical point person for Montgomery County would be its Senate Chairman and budget expert: Rich Madaleno. The problem is that he has written a proposal that targeted the county without vetting it with the rest of the delegation first, so trust is going to be an issue. How is our team supposed to prepare for the big game next year when some believe that our quarterback is wearing the other team’s uniform?

6. Big Daddy is still Big Daddy.

The biggest story of them all is once again the triumph of the Senate President. Annapolis is a grand echo chamber and Big Daddy is its master. He understands that if you repeat the same thing in private and in public for a long, long time from a position of authority that you will eventually get part or most of what you want. Better than anyone in the state, Miller uses patience, pressure and timing to move something from a crazy idea to an unlikely proposal to a serious policy consideration to a bill to a reality. That is why Maryland is getting slots. And that is why we are no longer arguing over whether to send pensions to the counties, but rather over how much of them to send. As long as the debate is conducted on Miller’s terms, he will command an overwhelming advantage.

And what happens then? A veteran Miller-watcher tells us, “You will never find anyone – ever – that has a better sense of how to smell and then exploit human weakness. He was born with this instinct.” MoCo, you have been warned.

Posted by

Adam Pagnucco

at

2:00 PM

![]()

![]()

Labels: Adam Pagnucco, budget, Rich Madaleno, Teacher Pensions

Tuesday, March 23, 2010

Teacher Pension Shift Passes the Senate

The teacher pension shift proposed by Senator Rich Madaleno (D-18) and passed by the Senate Budget and Taxation Committee has now passed the full Senate on a 28-19 vote. Following is the roll call.

Voting Yea

Mike "Big Daddy" Miller (D-Calvert/PG)

John Astle (D-Anne Arundel)

David Brinkley (R-Frederick/Carroll)

James Brochin (D-Baltimore County)

Richard Colburn (R-Eastern Shore)

Joan Carter Conway (D-Baltimore City)

Ulysses Currie (D-PG)

James DeGrange (D-Anne Arundel)

George Della (D-Baltimore City)

George Edwards (R-Western Maryland)

Barry Glassman (R-Harford)

Larry Haines (R-Baltimore/Carroll Counties)

Nancy Jacobs (R-Cecil/Harford)

Verna Jones (D-Baltimore City)

Ed Kasemeyer (D-Baltimore/Howard Counties)

Delores Kelley (D-Baltimore County)

Allan Kittleman (R-Carroll/Howard)

Kathy Klausmeier (D-Baltimore County)

Rich Madaleno (D-MoCo)

Nathaniel McFadden (D-Baltimore City)

Mac Middleton (D-Charles)

Donald Munson (R-Western Maryland)

E.J. Pipkin (R-Eastern Shore)

Catherine Pugh (D-Baltimore City)

James Robey (D-Howard)

J. Lowell Stoltzfus (R-Eastern Shore)

Norman Stone (D-Baltimore County)

Bobby Zirkin (D-Baltimore County)

Voting Nay

Roy Dyson (D-Southern Maryland)

Nathaniel Exum (D-PG)

Jennie Forehand (D-MoCo)

Brian Frosh (D-MoCo)

Rob Garagiola (D-MoCo)

Lisa Gladden (D-Baltimore City)

David Harrington (D-PG)

Andy Harris (R-Baltimore/Harford)

Nancy King (D-MoCo)

Rona Kramer (D-MoCo)

Mike Lenett (D-MoCo)

Alex Mooney (R-Frederick/Washington)

Anthony Muse (D-PG)

Doug Peters (D-PG)

Paul Pinsky (D-PG)

Jamie Raskin (D-MoCo)

Ed Reilly (R-Anne Arundel)

Jim Rosapepe (D-PG)

Bryan Simonaire (R-Anne Arundel)

We'll have more tomorrow.

Posted by

Adam Pagnucco

at

11:00 PM

![]()

![]()

Labels: Adam Pagnucco, Teacher Pensions

Madaleno Rocks MoCo on Teacher Pensions

Sixteen months ago, Montgomery County Executive Ike Leggett stared Senate President Mike “Big Daddy” Miller in the eye at a Committee for Montgomery Breakfast and told him, “We leave here with a mission, and that mission is we’re going to draw a line in the sand… And we’re not going to step back; we will protect our teacher pensions.” And who should cross that line in the sand but one of MoCo’s favorite sons: Senate Delegation Chairman Rich Madaleno (D-18).

Last Friday, Madaleno introduced a proposal to phase in sending part of the obligation for teacher pensions to the counties in the Senate Budget and Taxation Committee. The proposal passed by a 12-3 vote, with only Montgomery Senators Nancy King (D-39) and Rona Kramer (D-14) and Prince George’s Senator Doug Peters (D-23) voting against it. Specifically, Madaleno’s proposal would require the counties to pay 1% of teacher retirement costs in FY 2012, 3% in FY 2013, and 5% in FY 2014 and 2015. By FY 2015, the counties would be paying $337.5 million towards teacher pensions, of which $69.9 million would be paid by MoCo – easily more than anyone else. Furthermore, the payments would kick in just as federal stimulus money for education runs out. Here is the fiscal summary.

Most other MoCo policymakers had little or no warning of the proposal. That includes the vast majority of MoCo’s statehouse delegation and officials inside county government. This development surprised MANY people for the following reasons:

1. Madaleno is one of the top budget experts in the General Assembly and is Montgomery’s leader on those issues. He has stood up for the county’s interests in the past, leading a failed battle against the millionaire tax and opposing Prince George’s County’s efforts to grab more aid at MoCo’s expense. Madaleno knows better than anyone that teacher pension payment is one of the very few state aid programs that disproportionately benefits Montgomery. The county is fifth-from-the-bottom in state aid per capita overall but second-from-the-top in teacher pension payments per pupil in the state. For Montgomery, what state program besides transportation funding is more worthy of protection?

2. Perhaps more than any other county, Montgomery is in grave fiscal trouble. The county’s Chief Administrative Officer estimates the county’s future budget deficits at $519 million in FY 2012, $600 million in FY 2013, $683 million in FY 2014, $715 million in FY 2016 and $752 million in FY 2017. Why add tens of millions of dollars to those deficits?

3. Teacher pension is not only a Montgomery issue. The following counties derive a per-pupil benefit that is greater than the state average of $931 as of FY 2010 from the program:

1. Worcester: $1,134

2. Montgomery: $1,097

3. Kent: $1,050

4. Howard: $1,048

5. Somerset: $1,002

6. Baltimore City: $969

7. Prince George’s: $943

8. Allegany: $936

Despite the above benefit distribution, Howard County Senators Ed Kasemeyer (D-12) and James Robey (D-13), Baltimore City Senators Verna Jones (D-44) and Nathaniel McFadden (D-45) and Worcester/Somerset County Senator J. Lowell Stoltzfus (R-38) voted against their own constituents by supporting Madaleno’s proposal. Senate Budget and Taxation Committee Chairman and Prince George’s Senator Ulysses Currie (D-25) also voted in favor of it despite facing a possible challenge from Delegate Aisha Braveboy, who would be sure to use the issue against him if she ran.

Madaleno has enormous credibility in MoCo on budget issues, but he is taking some heat over this. One long-time admirer growled, “Rich is really off the reservation on this one.” Another observer was appalled, saying, “Wow, MoCo surrenders teacher pension without a fight.” Yet another complained about the lack of notice and said, “This is not the right way to do this.” And one influential policy maker, upon hearing of the cost to the county from the proposal, yelped, “We’re so screwed!”

Madaleno’s defenders offered theories to explain what happened while scratching their heads. One hypothesized that it was easier to negotiate with Governor O’Malley over the issue than with a possible Governor Ehrlich. Two more said that by offering a solution, Madaleno was earning MoCo a seat at the table. “If you’re not at the table, you’re on the menu,” said one veteran. Almost all our budget informants regard a partial handoff of pension obligations to the counties as inevitable. Even some of the fiercest public opponents concede - strictly off the record – that the counties are going to lose this issue. More than one believes that Madaleno’s proposal may be the best MoCo can get given the more draconian plans preferred by the likes of Big Daddy.

We will not raise the white flag until the last shot is fired. The teacher pension issue is hugely important to Montgomery County. It is not something to be given away for nothing in return because it affects our biggest long-term economic edge against our competitors in Virginia: the public schools. The Maryland Association of Boards of Education estimates that every $100,000 in pension costs passed down to the counties equals one-and-a-half to two teacher positions. MCPS is already preparing to increase average class size by one student due to existing budget problems. Montgomery cannot afford to maintain its per-pupil spending and will be applying for a state Maintenance of Effort waiver for the second straight year after never applying for a waiver in its previous history. What will happen to county schools if they bear even more budget problems? And how much more attractive will Fairfax become if MCPS suffers?

If Montgomery wants to preserve the quality of its schools, it must put up a tough fight and negotiate only when it has maximum leverage. That point is not now, but next year, when the next Governor – whoever it is – will have to pass a tax and spending package to deal with Maryland’s long-term budget deficits. Such a package cannot pass without MoCo’s votes. And that will be the time for the county to extract its terms on teacher pensions and anything else. As one of our spies says, “We are holding a handful of aces. Why fold when we can play them?”

Posted by

Adam Pagnucco

at

2:00 PM

![]()

![]()

Labels: Adam Pagnucco, budget, Rich Madaleno, State Aid, Teacher Pensions

Thursday, January 14, 2010

Can Teacher Pensions be Fixed? Part Four

Interest is growing in Annapolis in sending teacher pensions down to the counties. Manno’s bill offers a way out. But we are very cautious about predicting a happy end to this problem. Here’s why.

1. Target MoCo.

Is there anything easier to do in Annapolis than target MoCo? Our delegation has just two Committee Chairs and is packed with freshmen. Our County Executive does not have nearly the sway in the state’s capital that his predecessor had. And the county receives NO sympathy from any other part of the state. “You guys come across as a bunch of whiners,” says one high-ranking Annapolis source. The ICC is the one MoCo project that will be subsidized by the rest of the state through toll revenue transfers, and boy are they howling about it. Who cares when we howl about paying billions for Baltimore’s broken and convict-headed city government?

The only chance our delegation has at preventing a pension handoff is to emphasize its disastrous effects on the rest of the state. Here are the top ten beneficiaries of the subsidy in per-pupil terms in FY 2010.

1. Worcester: $1,134

2. Montgomery: $1,097

3. Kent: $1,050

4. Howard: $1,048

5. Somerset: $1,002

6. Baltimore City: $969

7. Prince George’s: $943

8. Allegany: $936

9. Garrett: $918

10. Calvert: $909

State Average: $931

2. Opposition from the business community.

Even if you are a tool-wielding proletarian, you should have sympathy for Maryland’s besieged business community. They have been clobbered again and again in Annapolis. The 2007 special session raised the top income tax rates, raised the corporate income tax and brought the hated computer tax. In 2008, the computer tax was replaced by the millionaire tax. Later that same year, transportation spending was slashed and the state’s tax competitiveness ranking dropped from 24th to 45th. And now there is talk of combined reporting and a permanent millionaire tax. Do the business lobbyists get paid enough to put up with all this?

Manno’s bill would stick the business community with the tab for teacher pensions. Business will reply, “It’s not our fault. The state screwed up its pension funds, not us. And you guys supposedly want to create more jobs, but where are they going to come from with new taxes?” One of our spies in the business community comments acidly, “I think they believe there is a jobs fairy.”

If the state employee unions get on board with Manno’s idea, there will be a titanic lobbying battle pitting labor against business. But it may not come to that. If the General Assembly decides to keep teacher pensions at the state level, they will choose the path of least resistance to finance them. Business will fight hard and perhaps avoid the guillotine, though some business taxes will surely pass. The ultimate targets will be the ones who are least aware of what is going on. As House Majority Leader Kumar Barve once told us, “In politics, when something unpleasant has to be done, it’s usually done to whoever squirms around the least!”

3. The chaotic nature of legislation.

In his comment above, Barve was referring to the genesis of the 2007 special session’s computer tax. The special session is not a desirable model for the inevitable 2011 deficit reduction package, but it is a very likely predictor of what will happen next time. Just as in 2007, the Governor’s staff will prepare a plan. Unlike in 2007, the Governor will not travel the state to sell it because no one talks about tax increases when running for re-election. In 2011, lots of freshmen will be serving in their first session. They will have no idea what is going on and will be easy prey for leadership and bureaucrats. Then the lobbyists will swarm in, ideas will be discarded as soon as they are created and chaos will ensue. The final result will bear no resemblance to sound public policy, but will be the easiest “fix” that can get to the Governor’s desk. We find nothing encouraging in such a scenario, but that is the way of Annapolis.

Manno’s bill is a sincere and intellectually honest effort to remedy the problems of the state’s pension system – problems which the state largely brought upon itself. Those who oppose his bill must either identify alternate revenues to pay for pensions or admit that county taxpayers will be on the hook when they are passed down. For us, honesty counts in government. Let’s see how much of it can be found outside Roger Manno’s office door.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, Can Teacher Pensions be Fixed, Roger Manno, taxes, Teacher Pensions

Wednesday, January 13, 2010

Can Teacher Pensions be Fixed? Part Three

Delegate Roger Manno (D-19) has proposed a bill to use revenues from a permanent millionaire tax and combined reporting to support the state’s beleaguered teacher and employee pension funds. Yesterday, we looked at whether those revenues would suffice and whether the state would suffer a competitive hit from new business taxes. Today we’ll examine a few more questions.

3. What happens to the General Fund?

Maryland’s General Fund is in big trouble. The last fiscal update projects General Fund deficits of $2 billion or more through FY 2015, with no estimate of what could be some ugly out years. We predict that the General Assembly will continue to use band-aids on the budget in 2010, but come back for a big tax hike in 2011. Manno’s plan would interfere in that effort in two ways.

First, Manno would get rid of the “Corridor Funding” method used by the state to calculate its required annual pension fund contributions. The State Retirement and Pension System (SRPS) described Corridor Funding this way in its 2009 Financial Report. In the 2001 legislative session, the Legislature changed the method used to fund the two largest Systems of the MD SRPS: the Teachers Combined System and the State portion of the Employees Combined System to a corridor method. Under this funding approach, the State appropriation is fixed at the June 30, 2000 valuation rate as long as the actuarial funded status of these Systems remains in a corridor of 90% funded to 110% funded. Once the ratio falls outside this corridor, the appropriated rate will be adjusted one-fifth of the way toward the underlying actuarially calculated rate…

Corridor Funding has been a disaster for employee pensions because it has allowed the state to systematically lowball its contributions. Prior to its adoption, the pension system had a 98.3% funding ratio in FY 2001. By FY 2007, the funding ratio had fallen to 80.4%. Bear in mind that the Standard & Poor’s 500 Index rose by 20% over this period, so the state lost a golden opportunity to capitalize on the stock market. Because of the continuous underfunding created by Corridor Funding, SRPS estimates that the state’s FY 2011 contributions will be 30% less than justified by actuarial requirements.

Under the present circumstances, the corridor method results in contributions that are less than those determined actuarially. We recommend a return to full actuarial funding at the earliest possible time.

Manno’s junking of Corridor Funding means that the state would be paying more to adequately fund its pension promises. But that means the money will not be available to pay off the General Fund deficit.

Second, if the Lords of Annapolis do go for a big tax hike in 2011, a permanent millionaire tax and combined reporting could very well be part of the package. The state needs those revenues for its General Fund, but Manno would dedicate them to pensions. If something like Manno’s proposal passes, the state would have to look elsewhere for tax increases.

4. How do tax options compare between the state and the counties?

Advocates for passing down teacher pensions to the counties argue that they have an unsustainable impact on the state budget. But we won’t let them masquerade as fiscal conservatives, because if they do go to the counties, those jurisdictions will inevitably raise their own taxes to pay for their new costs. Cutting benefits is probably not an option given the fact that the state recently hiked teacher pension benefits – a measure signed by Republican Governor Bob Ehrlich. In any event, no one is talking about giving the counties any input over benefit levels.

What tax options are available to the counties? A recent state financial report shows that the counties derived 41% of their revenues from two sources in FY 2007: property taxes (23.7%) and income taxes (17.6%). But that is misleading because those revenues include state and federal aid. In terms of locally-generated revenues alone, property and income taxes accounted for 62.3% of county receipts.

The distinguishing characteristic of both of these revenues is that they are broad-based. Property tax rates are not allowed to vary between residential and commercial properties. County income taxes use flat rates that cannot exceed a maximum rate of 3.2%. Three counties – Montgomery, Prince George’s and Howard – are already at that cap. Seven more jurisdictions - Allegany, Carroll, Harford, St. Mary’s, Somerset, Wicomico and Baltimore City – are at 3.0% or higher. That means the majority of the state’s residents live in jurisdictions that have little or no room to raise income taxes. So if pensions come down to the counties, property taxes will go up.

The state’s General Fund revenues are heavily dependent on income taxes (which accounted for 50.2% of FY 2009 revenues) and sales taxes (28.1%). But the state has much more freedom than the counties in targeting those taxes. The state can establish any income tax brackets it likes, while the counties must charge flat rates. The state can establish separate sales tax rates for many different products, including services, while the counties cannot levy general sales taxes. Our point is that if teacher pensions are sent down to the counties, they will be financed with broad-based taxes like property levies. But if teacher pensions stay at the state level, they can be financed with targeted taxes according to the whims of the General Assembly. That may be good or bad, but it is an important distinction.

5. What is in Montgomery County’s interest?

One of the arguments made against the millionaire tax was that it was bad for Montgomery County because most millionaires lived there. Combined reporting may also disproportionately target Montgomery County because it leads the state in business income. But Manno’s proposal may still be better for the county than the alternative.

Why? Montgomery benefits more in absolute terms than any other county from the state’s assumption of teacher pensions, getting a $150 million subsidy in FY 2010. Montgomery’s subsidy equaled $1,097 per pupil, trailing only Worcester County ($1,134). So using a permanent millionaire tax and combined reporting to pay for teacher pensions amounts to using Montgomery-focused revenues to pay for Montgomery-focused benefits.

The alternative is simple. The state could institute a millionaire tax and combined reporting to pay for its General Fund deficit while at the same time handing down pension costs to the counties. The pension handoff could even be wealth-adjusted, impacting Montgomery even more. This would be the equivalent of a simultaneous head shot, body punch and low blow on the Economic Engine of Maryland.

We’ll wrap this up tomorrow.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, budget, Can Teacher Pensions be Fixed, Roger Manno, taxes, Teacher Pensions

Tuesday, January 12, 2010

Can Teacher Pensions be Fixed? Part Two

Delegate Roger Manno (D-19) has introduced a bill that would keep teacher pensions at the state level, but pay for them with an extension of the millionaire tax and combined reporting for corporations. That strategy creates a cascade of budgetary and economic questions that goes far beyond the pension system itself. We’ll begin asking those questions today.

1. Are the millionaire tax and combined reporting enough to pay for pension cost increases?

The state’s October Spending Affordability Briefing reports that to maintain solvency of the teacher pension fund, the state must increase its contribution from $676 million in FY 2009 to $928 million in FY 2011 – a $252 million increase in just two years. The employee pension fund, which would also benefit from the new revenues recommended by Manno, must have its contributions increased from $258 million in FY 2009 to $393 million in FY 2011 – a $138 million increase. The briefing is silent on additional increases in the out years, but they are sure to be substantial.

Manno’s bill has no fiscal note yet, so we will have to rely on other sources to calculate the additional revenues raised by a millionaire tax extension and combined reporting. The millionaire tax, which in its current form is actually a three-year surcharge starting in Tax Year 2008, was estimated to raise a peak annual amount of $154.6 million in FY 2009 with declining amounts thereafter. The drop in the number of Free State millionaires, caused almost entirely by the recession, suggests that the tax raised substantially less than projected. And while only about 2% of the state’s millionaires have moved out because of the surcharge, many more could leave – and many more could never move in – if the tax was made permanent. However much a permanent tax might collect, what is clear is that it is a VERY volatile source of revenue. And the pension system needs a reliable and increasing source of contributions.

As for combined reporting, the Comptroller’s Office recently estimated that the state would have collected an additional $109-170 million in tax year 2006 if combined reporting had been in place. But the Maryland Chamber of Commerce noted:Tax year 2006 represented the highest level of corporate income taxes ever collected by the state ($868 million) during a robust economy. What would be the impact of combined reporting during the current recession when millions in tax losses could be imported into the state from out of state entities?

Moreover, if combined reporting did raise a large amount of money soon after its enactment, business would not sit still and simply absorb the losses. It makes sense that at least some of them would restructure their operations to adapt to combined reporting and minimize their tax liabilities. Some who could not sufficiently adapt might move out. So combined reporting could collect less over time. Further, corporate income is almost as volatile as top-level income tax revenue, generating more questions about contribution volatility in the pension system.

Based on the above, we believe that a permanent millionaire tax and combined reporting together could well generate tens, or perhaps even a hundred million dollars or more per year. But their tendency to experience huge swings with the business cycle suggests that more stable revenues need to be found to augment them to keep the pension system’s funding ratio from swinging like a pendulum.

2. What about the state’s tax competitiveness?

In considering any new taxes on business or the wealthy, policy makers must consider the consequences for the state’s ability to retain and attract jobs. Maryland could use some help on that score. From 1998 to 2008, Maryland added 272,600 jobs, an 11.7% growth rate, according to the Bureau of Labor Statistics. Over the same period, Virginia added 437,500 jobs, a 13.2% growth rate and D.C. added 91,300 jobs, a 14.9% growth rate. Maryland’s seasonally adjusted employment in October was 2,533,700, a decline of 3.1% from its all-time high of 2,616,000 in February 2008. Maryland’s seasonally adjusted unemployment rate has exceeded 7.0% for seven months starting in May 2009, the first time that has happened since 1983.

The 2007 special session’s tax increases for high income earners and corporations caused Maryland’s tax competitiveness to fall from 24th to 45th among U.S. states according to the Tax Foundation. Maryland remains at 45th in their latest survey. The principal reason for Maryland’s low ranking is its top income tax rate, which the Tax Foundation believes discourages entrepreneurship. Here’s how Maryland’s top rate compares to neighboring states.

Pennsylvania: 3.07% flat rate

Virginia: 5.75% over $17,000

Maryland: 6.25% over $1 million

West Virginia: 6.5% over $60,000

Delaware: 6.95% over $60,000

District of Columbia: 8.5% over $40,000

D.C.’s rate is not a fair comparison since the District government performs the functions of both a state and a local government.

Take away Maryland’s millionaire tax and it performs slightly better against Virginia. While Virginia charges 5.75% on income over $17,000, Maryland charges 4.75% on income between $3,000 and $150,000 and rates varying from 5% to 5.5% after that. But Virginia does not allow its counties to levy income taxes. Maryland does, and its counties can charge up to 3.2% as a flat income tax rate.

Here’s how taxes compare across several jurisdictions in the Washington D.C. area.

Like it or not, Maryland is in tight competition with Virginia and other surrounding states for jobs. Will retention of the millionaire tax have an employment cost over the long run? Furthermore, Delaware, Pennsylvania and Virginia do not have combined reporting. If Maryland enacts it, will those states get a competitive advantage?

We do not have the answers to these questions yet. But they should be answered before Maryland considers imposing a permanent millionaire tax or combined reporting. The latter issue is one of many now being examined by a commission established during the special session.

We’ll look at some more questions tomorrow.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, Can Teacher Pensions be Fixed, Roger Manno, taxes, Teacher Pensions

Monday, January 11, 2010

MCEA President: Teacher Pension Handoff "Unacceptable"

Following are the remarks of Montgomery County Education Association (MCEA) President Doug Prouty from the union's recent legislative breakfast, in which he brands any handoff of teacher pensions to the counties as "unacceptable." MPW readers who are not from Montgomery County should understand that the union's nickname here is "the 800-pound Gorilla of MoCo Politics," a title it has earned through repeated deployments of its fearsome Apple Ballot. Prouty also calls for adjusting per-pupil spending mandated by the state's Maintenance of Effort requirement for inflation.

Montgomery County Education Association, msea/nea

Annual Legislative Breakfast

Saturday January 9, 2010

MCEA Center for Leadership and Learning

Remarks of Doug Prouty, MCEA President

Good morning, and welcome to MCEA’s Annual Legislative Breakfast. This year’s event is a first in a couple of ways. This is my first Legislative Breakfast as President of MCEA. I was honored, and humbled, last spring to be elected MCEA President by our members. These are challenging times, and I take the responsibility of protecting and advancing the interests of our members – and of our schools and students – very seriously. I began my career in MCPS 14 years ago as a high school English teacher. But as a lifelong resident of Montgomery County and graduate of Montgomery County Public Schools, I have been a part of MCPS most of my life. Many of you may also remember my father – Keith Prouty – who was an activist and leader for social justice in our community for many, many years. He not only served as the chair of the NAACP’s Political Action Committee, but was also a consistent and vocal advocate for our schools; helping to found and lead the Education Political Action Committee back in the 1980’s and 90’s. I am committed to carrying on his legacy of leadership on behalf of the poor and working families of our community.

This is also the first MCEA Legislative Breakfast in our new conference center here at 12 Taft Court. Let me welcome everyone to our new home. The MCEA Board of Directors has made a major investment in the future of our organization, and we look forward to this facility being a resource for our members, and for the community, for many, many years to come. We have named our new conference center the “MCEA Center for Leadership and Learning” because we intend it to be a vehicle for just that: cultivating the lifelong learning and leadership development of educators.

This Legislative Breakfast is primarily a time for frontline educators to talk with our elected representatives about the needs in our classrooms and our schools. We are the 16th largest school system in the nation. All of us – from classroom teachers and school bus drivers, to school board members, county council members and members of the state legislative delegation, bear an awesome responsibility to do what is best for our children and their future. We want to share our collective priorities for education in the upcoming legislative session, and to reflect together on the state of public education here in Montgomery County and on what we must do to provide the best possible education for our 142,000 students.

Maintenance of Effort

The current debate over the state’s Maintenance of Effort requirements is one of the most important issues facing the public education community in the upcoming legislative session. Let me be perfectly clear – we do not believe that Maintenance of Effort is a “stupid” law. Quite the contrary. We believe that Maintenance of Effort is fair, appropriate, essential, and, in fact, not strong enough.

Maintenance of Effort (MOE) is the simple notion that if the state government increases its funding for local public education, that the local county government cannot then decrease its per-pupil spending. Increased state aid for education is expected to be spent on education, and not “supplant” local school funding dollars so county governments can spend the money on other priorities. There is nothing “stupid” about that.

Maintenance of Effort is actually a very low bar. If all a county did was meet Maintenance of Effort, over time it would be starving our schools. Maintenance of Effort makes no provision for the increased cost of goods and services: no provision for the increased cost of textbooks, energy to heat our classrooms, diesel fuel to run our buses, or cost-of-living adjustments for salaries to keep pace with inflation. Inflation has gone up 35% over the last ten years. Can you imagine how devastating it would be to our schools if all Montgomery County had done was simply maintain the same-dollar-per-pupil spending as it had ten years ago?

The point is simply that Maintenance of Effort should be a floor, and not a ceiling. It is indeed a very “low bar”, and simply exceeding Maintenance of Effort is hardly cause for celebration, or self-congratulation.

There is one part of the current Maintenance of Effort requirement that does not make sense- the provision that imposes a loss in state aid to a local school system as a consequence for a local county government not meeting Maintenance of Effort. This amounts to nothing less than punishing the victim. If a local county government fails to meet Maintenance of Effort, it is the county government that makes that decision – and not the school system – that should suffer any penalty. As the General Assembly considers changes to the Maintenance of Effort requirement, we very much hope that you will change this absurd situation so that the consequences of failing to meet Maintenance of Effort fall on those who make the decision, not on those who are already the victim of such decisions – our schools.

We are also supportive of the effort to enact a legislative waiver of any penalty on Montgomery County for the failure to meet Maintenance of Effort in the current fiscal year (2009-2010). As I just explained, to penalize our schools for a decision made by the county government is just wrong.

However, we strongly oppose any erosion of the Maintenance of Effort requirement. Some have proposed that if a county gets within 95% of Maintenance of Effort that should be good enough. Good enough is not- our kids deserve better.

Before the General Assembly acts to weaken the Maintenance of Effort requirement, I would suggest that it should – at the very least – adjust Maintenance of Effort to account for inflation. Maintaining per-pupil spending should be in inflation-adjusted spending, not just a fixed dollar amount. $10,000 in per-pupil spending in 2010 is a far cry from $10,000 in per-pupil spending in 1990. Changing Maintenance of Effort so that it is in inflation-adjusted dollars would be a much more honest standard for “maintaining local effort”. Let’s establish a more meaningful definition of Maintenance of Effort before we make it easier to get waivers.

State Budget

Clearly, the biggest issue facing the General Assembly in the upcoming session is the overall state budget deficit. I have yet to meet an elected official who did not proclaim their support for public education. But the real measure of the support is not what is said on the campaign trail, but rather what one does when times are tough. We understand that there will be difficult decisions ahead. The real friends of education will be those who are willing to make the hard choices so that support for our schools and our students is a top priority. We know it is not going to be easy. But our charge to you is to do all you can to protect and maximize state funding for our schools. We are counting on our delegation to ensure that Montgomery County does not bear a disproportionate share of whatever budget cuts are ultimately necessary.

Everyone here knows that Maryland’s schools have been rated the best in the nation. And I think we all know that Montgomery County’s schools are the best in the state. Neither we, nor our children, can afford to put that at risk.

State Funding of Teacher Pensions

An issue that is integrally related to the state education budget is continuation of state funding of the teacher pension plan. There are some in the legislature who want to shift future increases in the cost of teacher pensions to local governments. For them, this is the answer regardless of what the question is. It’s like a broken record.

As my predecessor, Bonnie Cullison, said last year, this is unacceptable. We applaud the bold statement made by our county executive, Ike Leggett, that this is a ‘line in the sand” that should not be crossed. In fact, we consider it a “line in cement” and one that cannot be rubbed out or washed away.

Let me take a moment to review some of the key arguments the Montgomery County delegation needs to be making in order to maintain state funding of teacher pensions.

• First, state funding of teacher pensions is one of the only state aid formulas that favors Montgomery County. A reduction in the state’s commitment will disadvantage Montgomery County disproportionately.

• Second, state funding of teacher pensions is a long-standing part of the complex balance between the state and local jurisdictions on both revenue and expenditures. It is simply unfair to pass these expenses back to the counties without also passing back revenue sources as well.

• Third, this isn’t a strategy for balancing the budget; it’s a strategy for passing the buck. Every single county would suffer. When there is a budget deficit, you have to either increase revenues, decrease expenditures, or both. Shifting the costs to somebody else doesn’t help to solve the problem.

• Fourth, this is a long-term solution to a short-term problem. We all recognize that our state – and our nation – face a serious recession. But like all recessions, we will get through it and the economy will recover. It is disingenuous to advocate for a long-term change in the relationship between the state and the counties as a solution to a short-term budget shortfall.

• Finally, it is simply unfair to force the counties to pay for a pension system that is controlled by the state. The state legislature determines the benefit formulas. The state pension board oversees both the administration of the plan and the investment of its assets. How can anyone argue that the counties should be expected to pay for a state-run program over which the counties have no control? As we have said before, the next thing you know the president of the state senate will be telling the counties they have to pay for the state police as well; after all – the crime occurs in the counties.

United, our delegation has the size, strength, and sophistication to block any budget that that deeply harms our county. Now you have the opportunity to show your true mettle. I would encourage each and every member of the delegation to go on record stating that they will not vote for any budget that includes any shift in funding for teacher pensions. Only then will the leadership understand that this cannot be a part of any package.

While the budget issues are foremost on everyone’s mind, there are three other, non-economic issues before the legislature this year that I would like to mention.

Public Employee Labor Relations Bill

For several years, we and the Maryland State Education Association have advocated for reform of the collective bargaining law that was first created 40 years ago for school employees. It is antiquated and needs to be updated to meet the challenges of today’s environment. Last year our own State Senator Jamie Raskin and Delegate Sheila Hixson introduced bills in their respective chambers to improve the processes for resolving labor management disputes. A much amended bill passed the Senate, but was unable to be brought back up in the House as the clock ran out of time at the end of the session. Senator Raskin, with the co-sponsorship of Chairman Mac Middleton will be resubmitting the amended bill, as will Delegate Hixson in the House. We have already spoken with most of our senators and delegates. And I am very pleased to report that virtually every single member of the Montgomery County legislative delegation has agreed to co-sponsor this bill. Thank you very much for your support.

BOAST Bill

The so-called Building Opportunities for All Students and Teachers (BOAST) Maryland Tax Credit bill is nothing more than a tax credit scheme that is a backdoor approach to providing vouchers to parents of students in nonpublic schools.

The research in Arizona, Illinois, and Pennsylvania shows that the greatest beneficiaries of such tax credit programs are wealthier tax payers and schools in middle and upper income neighborhoods. A study by the non-partisan RAND Corporation concluded that tuition tax subsidies rarely benefit poor children. It is families already attending private or religious schools that benefit the most. And as with vouchers, tuition tax credits provide funds to nonpublic schools without regard to the schools’ entrance policies. Some private schools do and would continue to deny entrance to certain students.

When facing a budget shortfall, the state cannot afford to lose revenue through a tuition tax credit that subsidizes private school tuition. We urge all of our legislators to continue to oppose this ill-conceived idea.

In Conclusion

We all have a challenging year ahead of us: whether it be the MCEA members here who face increasing demands every day to do more with less, or the elected officials who face the daunting task of figuring out how to fund the services our communities desperately need and cannot afford to lose.

I have already met and worked with many of the elected officials here today, and I look forward to getting to know all of you better in the coming months and years. During these challenging times, it is our ability to work together collaboratively that will lead to the best outcomes. Far too often, we see legitimate discussions over policy differences devolve into personal conflicts and political gamesmanship. My goal is to work with all of you: MCEA members, state legislators, county council members and board of education members, to put aside the personal and political agendas so that we can focus on how to best meet the needs of our students, our schools, and the thousands of dedicated, hard-working school employees who work miracles every day with our children.

Thank you all for coming out this morning, and for everything you do on behalf of our schools and our students.

Posted by

Adam Pagnucco

at

7:00 PM

![]()

![]()

Labels: Doug Prouty, Maintenance of Effort, MCEA, Teacher Pensions

Can Teacher Pensions be Fixed? Part One (Updated)

Delegate Roger Manno (D-19) has proposed an ambitious plan to fix the state’s troubled teacher pension program as well as to prevent pension liabilities from getting passed down to the counties. But his remedy is sure to provoke big questions about tax competitiveness, equity and general fund deficit solutions, as well as to possibly pit two of the state’s most powerful lobbies against each other.

Maryland’s State Retirement and Pension System (SRPS) administers five defined benefit pension systems: teachers (106,107 participants on 6/30/09), government employees (89,448), law enforcement officers (2,445), state police (1,408) and judges (297). The five systems together had $34.3 billion in assets and $51.4 billion in liabilities in FY 2009, meaning that they were unfunded by $17.1 billion. The unfunded liability increased by $6.4 billion in just one year and the system is now only 65% funded. The employees covered by these plans are mostly state workers with the notable exception of teachers and other school employees. Counties negotiate contracts with the school employees, and the promised pension benefits – which are tied by formula to county-set compensation – are paid by the state. Some state politicians – notably Senate President Mike “Big Daddy” Miller - would like to see the counties pick up at least part of the cost of the teacher pensions.