Today, Maryland Democrats are celebrating the reelection of Governor Martin O’Malley, U.S. Senator Barbara Mikulski and their holding onto both chambers of the General Assembly. But the reality of governance will soon set in. Why?

Because the Republicans have won control of the U.S. House of Representatives, and that means federal stimulus aid for the state government has almost certainly dried up.

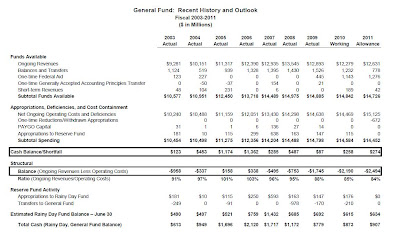

Maryland’s state government has been subsidized by federal stimulus money under ARRA (the American Recovery and Reinvestment Act of 2009) for three fiscal years: 2009, 2010 and 2011. According to the state’s latest Spending Affordability Committee report, the state government has received $4.4 billion of stimulus funding over the last three fiscal years. The largest subsidies have been directed to Medicaid ($1.6 billion), education ($1.1 billion) and infrastructure ($781 million).

The stimulus funds have been invaluable for closing Maryland’s general fund deficits. In FY 2009, 2010 and 2011, the state racked up $6.4 billion in structural general fund deficits. It has used $2.9 billion of federal stimulus money to help close those deficits. That means federal money has been used to plug almost half of Maryland’s budget gaps.

With the election of a Republican U.S. Congress, that money is gone. And Maryland faces a general fund deficit in FY 2012 that could be as high as $1.6 billion. That leaves a number of unappetizing options to deal with it.

Budget Cuts

In FY 2011, 41% of all state general fund spending was sent as aid to local governments. By spending category (which overlaps local aid), 50% of the general fund goes to education, 24% goes to health care and 9% goes to public safety. Those three items combined account for 84% of the general fund in FY 2011. It’s probably impossible to have meaningful long-term spending cuts without touching one or more of these areas.

Teacher Pensions

In the 2010 session, the Senate passed a plan to phase in a partial handoff of teacher pension obligations to the counties. The plan would have saved the state no money in FY 2011, $63 million in FY 2012, $194 million in FY 2013 and more than $300 million annually in the out years. Those out year revenues are significant, but the state’s budget problems may necessitate collection of them earlier. So the General Assembly could well choose to accelerate the phase-in and make the counties assume a greater share of the cost than in the Senate’s plan.

Diversion of Transportation Revenues

The Transportation Trust Fund (TTF) claims over $800 million a year in state funding. The TTF’s revenues include vehicle titling fees (20%), gas taxes (19%), registration fees (15%), operating revenues (10%), sales taxes (6%), corporate income taxes (4%) and more. All are ripe for diversion to the general fund. The General Assembly has already seized transportation money due to the counties so state transportation money could be next. That would be a disaster for the state’s infrastructure, but if transportation advocates are pitted against education advocates, who do you think will win?

Tax Hikes

The three most discussed taxes are an extension of the millionaire tax (which was supposed to last for three years), the imposition of combined reporting to capture more corporate income taxes and an extension of the sales tax to services. The first two options will be resisted by the business community and both have very uncertain revenue generating capabilities. The last time the state tried to extend the sales tax to services, the result was the much-hated computer tax (which was repealed in 2008).

Casting a long shadow over the taxation debate is the state’s competitive position with its neighbors – especially Virginia. The Tax Foundation’s FY 2011 tax competitiveness report ranks Delaware #8, Virginia #12, Pennsylvania #26, West Virginia #37 and Maryland #44 of the fifty states. Here is how Maryland compares to Virginia on a few tax measures.

Corporate Income Tax

Maryland: 8.25%

Virginia: 6.00%

Top Income Tax Rate

Maryland: 6.25% (at $1 million income)

Virginia: 5.75% (at $17,000 income)

Sales Tax

Maryland: 6%

Virginia: 5%

Maximum Unemployment Insurance Tax Rate

Maryland: 13.5%

Virginia: 6.2%

At least the state will not have to pay for Bob Ehrlich’s proposed $700 million sales tax cut.

Now what were we saying about celebrating?

Wednesday, November 03, 2010

Now Comes the Hard Part

Posted by

Adam Pagnucco

at

2:00 PM

![]()

![]()

Labels: Adam Pagnucco, budget, State Aid, taxes, Teacher Pensions, transportation

Thursday, October 28, 2010

Bob Ehrlich: The Anti-MoCo Candidate, Part Two

In Part One, we showed how Bob Ehrlich’s positions on transportation and the Purple Line would damage Montgomery County. Today, we examine a different set of issues that are connected to another county priority: education.

Teacher Pensions

For decades, the state government has administered and financed a pension fund for teachers and other local school employees for the purpose of attracting talented educators. The system has contributed to Maryland’s repeated Number One ranking for its public schools. But the pension fund has encountered three problems: a change to the state’s contribution formula enacted during the Glendening administration that allowed the state to lowball its payments into the fund, investment performance problems during the recent stock market crash, and a large unfunded benefit increase signed by Governor Ehrlich. The state will either have to increase its contributions to the pension fund, restructure future benefits, or both. But some in Annapolis have a different idea: pass down the funding obligations to the counties even though they did nothing to cause the problems.

The state’s assumption of teacher pensions is one of the few state programs that benefit Montgomery County. That’s because MoCo hires lots of teachers and has to pay them well to compete with the rest of the Washington area. Most of the state’s other aid programs are tied to wealth formulas that send MoCo tax dollars away to other jurisdictions. In the last session, the Senate passed a handoff plan that would have cost MoCo $192 million over four years – far more than any other county. MoCo already runs nine-digit annual budget deficits and such an additional cost would play havoc with county services.

So what of the two candidates for Governor? Ehrlich favors at least a partial shift while O’Malley is vague. We do not find O’Malley’s ambiguity comforting. But the truth is that O’Malley has had multiple opportunities to pass down pension liabilities to the counties, an idea aggressively supported by the Senate President, and he has not done so. Ehrlich’s election would certainly saddle MoCo with a gigantic pension obligation that it cannot afford, while O’Malley’s reelection would give the county a little bit of hope that we can negotiate something marginally better. On this issue, MoCo’s interest aligns with O’Malley.

Education Funding

Maryland’s Number One public schools ranking depends not only on the state’s funding of teacher pensions, but also in part on the massive amounts of state aid that go to its local school systems. Much of that school aid has its roots in the 2002 Thornton Plan, which committed the state to hundreds of millions of new dollars in school spending. Education funding is popular in Maryland, but Thornton is not just an aid program: it is also effectively a transfer program because it is driven by wealth formulas. That means the state disproportionately funds “poor” jurisdictions with money taken from “wealthy” jurisdictions.

Let’s put aside the fact that MoCo is not as rich as the state believes. Montgomery County has one-sixth of the state’s population, pays one-fifth of the state’s combined income and sales tax revenues and accounts for one-third of its business income. One would believe that the county would receive comparable benefits from the state in return. But in FY 2009, MoCo received $166 million of the state’s $2.8 billion in base education aid, or just 6% of the total. This is despite the fact that MCPS has a higher percentage of limited English students than any other jurisdiction in Maryland.

Back in 2002, when the Thornton Plan was being drafted, then-County Executive Doug Duncan and his top budget expert, future Senator Rich Madaleno, were aware that this kind of disparity would result. So they pressed the state to include a program with Thornton that would later be known as the Geographic Cost of Education Index (GCEI). The point of GCEI was to direct additional money to jurisdictions that experience higher costs of educating students. Because the program also benefited Baltimore City and Prince George’s County, it passed the legislature along with Thornton – but only as a discretionary spending item. Governor Ehrlich refused to fund it. Governor O’Malley phased in funding over his term.

GCEI is a relatively small program, even under O’Malley. It accounts for $127 million of the state’s $2.9 billion in school aid in FY 2011, of which just $31 million goes to MoCo. (Prince George’s County gets $39 million.) But Bob Ehrlich has targeted it for elimination to partially pay for his proposed sales tax cut. Ehrlich told the Associated Press that the program was “a political ploy” and that “It was all about getting votes in the 2002 session… They just made it up to get votes from Montgomery County to pass Thornton in the first place.”

Let’s be clear, Governor Ehrlich. We in Montgomery County pay more in taxes to the state than any other jurisdiction. We are entitled to ask for a fair share of state money in return. We support any effort by our delegation to fund public education and to bring back the dollars we need for MCPS. Any politician who has a problem with that does not deserve our vote.

Want more? Come back tomorrow for Part Three.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, education, GCEI, Martin O'Malley, Robert Ehrlich, State Aid, Teacher Pensions

Thursday, October 07, 2010

Ehrlich vs. O’Malley on School Construction

State political news has been dominated this week by the debate between Bob Ehrlich and Martin O’Malley on state education aid, a worthy topic on which we will have some comment. But operating support is only one side of state funding for local schools. The other side is capital support for school construction. How did the two Governors do on that measure during their terms in office?

First, let’s understand how the state makes funding decisions on school construction. The Public School Construction Program (PSCP) is administered by staff overseen by the Board of Public Works, a three-person body consisting of the Governor, the Comptroller and the state Treasurer. Every year, the state’s twenty-four local school districts submit capital funding requests to PSCP. Those requests are reviewed by the staff and an inter-agency committee comprised of the State Superintendent of Schools (Nancy Grasmick), the Secretaries of the Departments of General Services and Planning, and one member each selected by the House and the Senate. The staff and the inter-agency committee review each school district’s capital submission to determine those projects with the most merit and forward their recommendation to the Board of Public Works. State support is given in the form of matching grants for local contributions, with the state paying a higher percentage of project costs in “poor” jurisdictions than in “rich” ones. The school districts can appeal that recommendation to the Board before the Board takes a final vote.

Obviously, the Governor is not the only player in this process, but he is the single most important player. Early on, the Governor determines a preliminary allocation for school construction, which sets the total pie available for school construction funds. This preliminary allocation then forms the basis for a bond authorization to be passed by the General Assembly which actually pays for the state’s school construction funding. And while the Governor does not directly determine funding allocations by county, he can substantially influence that decision through his appointment of two of the five inter-agency committee members and his relationship (or lack thereof) with Grasmick.

In practice, the counties submit more money in requests than they know the state will approve. Many small jurisdictions submit small requests and get most or all of them approved. Big jurisdictions submit massive requests and get less of them approved, but they also get more money. The biggest factor influencing the entire process is how much money is available – and that is the Governor’s call.

Here are the amounts of school construction funding requested by the counties and approved by the state during the Ehrlich and O’Malley administrations.

Unsurprisingly, the amounts requested by the counties have gone up – WAY up – during the last eight years. In Ehrlich’s first year, the counties asked for $310 million in school construction money. This year, the counties asked for $729 million. The state’s approval rate has varied between 30% (in FY 2005) and 45% (in FY 2008). Total amounts have risen substantially over time as O’Malley has raised his school construction funding allocation to keep pace with the counties’ rising requests.

Here are the total amounts of school construction funding requested and authorized by county for the two Governors’ terms.

The Ehrlich administration approved $765 million in school construction money. The O’Malley administration approved $1.2 billion in school construction money, a 63% increase. Part of this was driven by more funding requests from the counties, but O’Malley made more money available to meet them. Nineteen of the state’s twenty-four jurisdictions received more school construction funding under O’Malley than under Ehrlich. Every county that saw a decrease asked O’Malley for less money than they asked from Ehrlich.

Here are the school construction funding increases enjoyed by the state’s eight largest jurisdictions under O’Malley’s term relative to Ehrlich’s term.

Anne Arundel: +95%

Harford: +93%

Montgomery: +92%

Baltimore County: +89%

Baltimore City: +82%

Prince George’s: +73%

Howard: +56%

Frederick: +37%

Bob Ehrlich served as Governor in fat budget times but only made school construction a priority in the year he ran for reelection. Martin O’Malley has served as Governor in lean budget times but has made school construction a priority every year.

For those who are concerned about crowded schools, the choice is clear: O’Malley.

Posted by

Adam Pagnucco

at

2:00 PM

![]()

![]()

Labels: Adam Pagnucco, budget, education, Martin O'Malley, Robert Ehrlich, schools, State Aid

Tuesday, September 21, 2010

The Problem with Maryland's Wealth Formulas

Most state aid in Maryland is driven by wealth formulas that direct more aid per capita to “poorer” jurisdictions and less to “wealthy” jurisdictions, thereby effecting significant income transfers. But the wealth formulas used by the state have a critical flaw: they are absolutely unrelated to poverty.

Almost all state aid is distributed in one of four ways. First, it can be distributed on the basis of wealth. Second, it can be distributed on the basis of “workload,” or a tangible volume measure like population, road mileage or student enrollment. Third, it can reimburse jurisdictions for all or part of actual costs they pay for specific programs. Fourth, it can match prior year disbursements. A tiny minority of programs are tied to other formulas.

Wealth formulas are a dominant and growing method of determining state aid. In FY 1990, wealth formulas drove 38.5% of state aid. In FY 2010, wealth formulas drove 68.8% of state aid. Much of this increase is driven by the large increases in aid to public schools produced by the 2002 Thornton program.

Maryland’s wealth formulas are typically driven by two components: assessable property tax base and net taxable income. Both components have problems. First, high-value properties are often encumbered by high mortgages. People with highly assessed properties, big mortgages and little or no equity are hardly wealthy. Second, high incomes usually reflect high costs, and those are not considered in the wealth formula at all. Both of these issues plague Montgomery County, which has high incomes and high property values but also has big mortgages, high gasoline costs and lots and lots of foreclosures.

But perhaps a bigger issue is that the wealth formulas are utterly unrelated to the number of poor people living in each jurisdiction. Helping jurisdictions educate and provide services to the poor should be a central goal of any state as dedicated to income redistribution as is Maryland. Otherwise, why do it? Poverty is an especially important consideration in public school spending, which accounted for 88% of all state aid in FY 2010, because poor kids are likely to need free-and-reduced price meals as well as extra instruction.

Below, we show total population and population living in poverty for sixteen Maryland jurisdictions on which the Census Bureau has data for 2008. We also show total aid payments to each of those jurisdictions. Bear in mind that over two-thirds of these payments are driven by wealth formulas. Finally, we show state aid per person living in poverty for each jurisdiction.

In FY 2010, the state spent an average amount of $14,202 for every Marylander living in poverty. But that figure fluctuated wildly between the jurisdictions. Baltimore City leads the state in aid ($1.2 billion) and in poor people (119,340), but is dead last in aid per poor person ($9,704). Howard County, which has the highest median household income in Maryland, gets the most aid per poor person ($27,318). Why should the state’s richest jurisdiction get three times the aid per poor person as the state’s poorest jurisdiction? Montgomery County fares badly on this measure, having the state’s third-highest population in poverty and yet getting less than the state average ($12,397) in aid per poor person. Prince George’s County, which actually has fewer poor people than Montgomery, receives much more aid per poor person ($21,378).

Given the above data, it’s difficult to conclude that the wealth formulas as currently structured by Maryland serve any progressive purpose. Relative to poverty, the state aid payments appear to be sprayed around virtually at random. If they are to be useful for any reason other than parochial politics, the wealth formulas should include measures tied to the actual numbers of poor people living in each jurisdiction. If not, they should simply be abolished.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, State Aid

Tuesday, March 30, 2010

How to School Annapolis

This year was supposed to be a lean year in the statehouse. Cuts were everywhere. Furloughs and pink slips were being handed out left and right. State aid and teacher pensions were on the chopping block. But somehow, the Prince George’s County state legislators were able to bring home an extra $18 million. How did they do it?

Take a seat, folks, because class is in session!

The Prince George’s delegation, also known as “the PeeGees,” is the second-largest county delegation in Annapolis. Six Senators and eighteen Delegates represent Prince George’s County alone. Two more Senators and five more Delegates have split districts that include pieces of Prince George’s. One of those Senators is Senate President Mike “Big Daddy” Miller, who has priorities that go far outside the county. The delegation has three standing committee chairs: House Economic Matters, House Judiciary and Senate Budget and Taxation. The group is more diverse than most people appreciate, ranging from do-gooder liberal Senator Paul Pinsky (D-22) to ethically-challenged, head-breaking Senator Nathaniel Exum (D-24) to young, wonky Delegate Justin Ross (D-22) to old, gruff House Judiciary Chairman Joe Vallario (D-27A) to smart, savvy House Economic Matters Chairman Dereck Davis (D-25), a potential future Speaker of the House. Senate Budget and Taxation Committee Chairman Ulysses Currie (D-25) is one of Big Daddy’s top lieutenants and makes sure his committee never strays too far from the boss. The Senators are all men, but a pack of young, hungry female Delegates is breathing down their necks and may someday take a couple of them out.

One spy says, “They are great street fighters. O’Malley fears them. They are the ‘victimized’ and they all believe it. They are much better at the ‘game’ – they take it personally, they take pride in ‘winning,’ and they are held accountable for playing it well by churches, etc. – not just one union.” The only sense of victimization felt by many MoCo legislators is the fact that they have not yet been elected to Congress.

As powerful as the PeeGees are, they have a problem: despite the incompetent administration of County Executive Jack Johnson, the county’s wealth is growing relative to the rest of the state. You might think that’s a good thing, but not in Maryland. The state’s wealth formulas punish economic success by diverting aid away from rich counties towards poorer ones. In the Governor’s FY 2011 budget proposal, Prince George’s was scheduled to take a 3.0% cut in aid, the biggest drop in the state. That’s just disrespectful, and no one disses the PeeGees. Here are the three things they did to turn the tables and bring home eighteen million slices of bacon.

1. Get Some Leverage

As of February 2010, 57% of Montgomery County registered voters were Democrats and the county votes overwhelmingly Democratic in every statewide election. So there has always been a sense that Democratic Governors can take MoCo for granted and hand out goodies for votes elsewhere. But 78% of registered Prince George’s voters are Democrats. Why doesn’t the same conventional wisdom apply to them?

The reason is because Prince George’s support does not come for free. They make a Governor work to get it. Three years ago, the biggest issue in the county was its deteriorating hospital system, which was on the verge of outright collapse. Governor O’Malley moved to save it by pouring tens of millions of state dollars into the system until a buyer was found. Meanwhile, the county government is trying to weasel out of its own payments to the hospital.

But the Governor’s unprecedented intervention wasn’t good enough for Prince George’s politicians as many of them withheld their endorsements last fall. (At the same time, nearly all MoCo politicians jumped on the O’Malley bandwagon despite having been screwed on school construction money the year before.) Prince George’s Delegate Dereck Davis, a power broker who chairs the House Economic Matters Committee, explained his non-endorsement to MPW this way:…I have not endorsed anyone for Governor. Quite candidly, I think it is premature to endorse anyone until after the 2010 legislative session has been completed. Then, and only then, will I be able to make an informed decision about what’s best for the community I represent.

Translation: Give us a little more, Governor. That opinion was shared by the legions of Prince George’s politicians who swarmed into potential primary challenger Wayne Curry’s birthday party. The party was a bombshell that scattered shrapnel all over Annapolis and in hindsight was one of the best things to happen for the county.

So isn’t this ungrateful behavior by the PeeGees? Of course, but it also creates the most valuable commodity in politics: leverage. And O’Malley’s promise to help the county in its quest for more aid was a direct response to such tactics.

2. Be Persistent

Prince George’s politicians have been beating the drum on state aid for a long time no matter who has been in the Governor’s office. The latest rumble started last year, when the county’s increasing wealth caused a 1.2% cut in its state aid. Exum confronted O’Malley aide Joe Brice about it:“It is clear Prince George's County has been hurt by these cuts,” he said. “We want to know what the Governor is going to do to rectify this? Because next year is 2010. And who is the Governor going to look for in his reelection campaign?”

Delegate Justin Ross followed up with a bill to change the school aid formula, telling the Post that it was a “fairness issue.” The bill was voted down by the House Ways and Means Committee, but the PeeGees had laid down their marker for 2010.

Brice responded that O'Malley would try to bring all lawmakers together and work with them on the budget.

“As long as he is aware,” Exum shot back.

This year Ross reintroduced that bill, which would have generated $39.6 million in new school aid for the counties. Prince George’s would have received $13.4 million, the most of any jurisdiction. Charles County would have been second with $4 million. MoCo would have received zero dollars. The PeeGees began sniping at MoCo in the Post over aid even though they were already getting FAR more aid than MoCo. Clearly, the PeeGees were not going to give up. O’Malley and the General Assembly leadership got the message.

3. Get Some Allies and Cut a Deal

There are three ways to get allies and cut a deal: persuasion, pressure and working out mutual gain. The PeeGees used all three to fix their aid problem.

Persuasion: The case made by Ross for a formula change involved the appropriate timing to determine wealth. Current state wealth formulas are based on tax returns filed through August 15 or September 1, but wealthy people often get extensions and file later. Ross and the PeeGees argue that undervalues the true wealth of jurisdictions with a lot of rich people in them, like MoCo, so they want to move the formula date to November 1. MoCo budget expert Senator Rich Madaleno (D-18) bought that argument, telling Ross that he had made a “compelling case” for changing at least one of the state’s formulas. Ross said, “Prince George’s County has no greater friend than Montgomery County in the legislature.” Oy!

Pressure: This is the product of the leverage and persistence discussed above. O’Malley needed Wayne Curry out of the way and the PeeGees were not going to cooperate until they got some bacon. As a result, the General Assembly’s leadership understood the importance of taking care of Prince George’s.

Mutual Gain: No budget bickering occurs in a vacuum in Annapolis. Everybody has complaints, and those who want to play ball can get some relief. This year, Baltimore City, MoCo and Prince George’s were each thrown a bone. The city got to keep the street maintenance money that some other jurisdictions were trying to take away. MoCo got to escape its Maintenance of Effort (MOE) fine. And the PeeGees got a change to the wealth formula covering disparity grants, which subsidize “poor” jurisdictions, that gave them $18 million. (They’ll be back for the much-larger education formula next year, and that will cost MoCo big-time.) So the city got to keep something it already had, MoCo avoided a fine it should never have had to pay and Prince George’s got brand new money. Who do you think made out the best?

Let’s not overstate our case. There are no LBJs running around the Prince George’s delegation and they have problems like everyone else. A few of them are deadwood, a few of them are banana-cakes and at least a couple of them are probably crooked. But as a group, they know how to squeeze the orange and get some juice to come out.

Now compare the above to our legislative “strategy” on teacher pensions. Our plan to avoid having Big Daddy stick it to us next year was to stick it to ourselves this year. Leverage, persistence, pressure, negotiation, posturing, recruiting allies, lining up votes, tough bargaining – you know, all those unsavory things that Big Daddy and the PeeGees do – well, some of our guys are too good for that. Others just don’t care because they are in Annapolis for other reasons. “Frankly, funding Ike and Nancy Floreen’s pet projects doesn’t get me out of bed in the morning,” sneers one MoCo delegation member.

Hear that? That was the bell. Class is dismissed.

Did we learn anything?

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, budget, Montgomery County Delegation, Prince George's, State Aid

Friday, March 26, 2010

How the Counties Spend Your Money, Part Five

Today, we examine public school spending and look at Montgomery County’s per capita budget in detail.

In FY 2009, Maryland’s twenty-four public school districts received a combined $11.2 billion. Of that sum, $5.3 billion came from state aid, $529 million came from federal aid and $5.4 billion came from county taxes. Aid to public schools is the single biggest line item in the state’s budget and accounts for over a third of its general fund expenditures. But school aid is not distributed evenly. Instead, like almost all other forms of state aid, school aid is apportioned based on a wealth formula that favors jurisdictions with lower property values and lower incomes over counties that perform better on those measures. That has real consequences.

Here is total and per capita school spending by source for each county.

In per capita terms, the leaders on local school spending are Howard ($1,654), Montgomery ($1,592), Worcester ($1,474) and Calvert ($1,135). The lowest spender of local money on schools is Baltimore City ($326). But the city makes that up by being the biggest beneficiary of state aid ($1,417 per capita) and federal aid ($178). In terms of per capita funding from all sources, Baltimore City ($1,922) is very close to the state average ($1,994).

The wealth formula creates enormous disparities on the local burden of funding public schools. In FY 2009, here are the percentages of public school district budgets paid by state and federal aid.

On one hand some jurisdictions have overwhelming percentages of their school budgets covered by the state and federal governments, including Baltimore City (83%), Caroline County (80%), Allegany County (78%), Somerset County (76%) and Wicomico County (72%). All of these jurisdictions contribute much less than the state per capita average in local funding to their schools. On the other hand, other jurisdictions largely go it alone, such as Worcester County (28%), Montgomery County (28%), Talbot County (31%) and Howard County (36%). Taxpayers in Worcester, Montgomery and Howard pay very large amounts to maintain their own schools as well as the schools everywhere else in the state.

And what of Montgomery County? The county’s colossal FY 2011 budget deficit is prompting questions by many elected officials and staffers as to where the county’s spending is going and whether it is justified. Here is how Montgomery’s per capita spending compared to twenty other counties around the state for which we have data in FY 2009.

On a per capita basis, Montgomery spends more than the vast majority of other counties on pretty much everything. The only major items in which it is middle-of-the-pack or lower are the Board of Elections (on which it ranked 11th), economic development (11th) and the State’s Attorney office (19th). But in terms of total spending, the county ranks high for one big reason and one less important reason.

The big reason is schools. As we have seen above, Montgomery is a big-time loser in school aid due to the wealth formula. The county has chosen to overcome that handicap through massive local spending on its schools. The less important reason is the county’s health and human services spending. As we saw in Part Three, Montgomery spends almost seven times as much per person on health and human services as does Prince George’s County. Montgomery is effectively subsidizing Prince George’s on that measure by paying for the needs of the latter county’s poor.

If Montgomery wants to get more state aid, there is a quick way to do it: get poor – the faster, the better. Given the calamitous state of the county’s economy, that option is not completely out of the question.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, education, How Counties Spend, MCPS, Montgomery County, State Aid

Tuesday, March 23, 2010

Madaleno Rocks MoCo on Teacher Pensions

Sixteen months ago, Montgomery County Executive Ike Leggett stared Senate President Mike “Big Daddy” Miller in the eye at a Committee for Montgomery Breakfast and told him, “We leave here with a mission, and that mission is we’re going to draw a line in the sand… And we’re not going to step back; we will protect our teacher pensions.” And who should cross that line in the sand but one of MoCo’s favorite sons: Senate Delegation Chairman Rich Madaleno (D-18).

Last Friday, Madaleno introduced a proposal to phase in sending part of the obligation for teacher pensions to the counties in the Senate Budget and Taxation Committee. The proposal passed by a 12-3 vote, with only Montgomery Senators Nancy King (D-39) and Rona Kramer (D-14) and Prince George’s Senator Doug Peters (D-23) voting against it. Specifically, Madaleno’s proposal would require the counties to pay 1% of teacher retirement costs in FY 2012, 3% in FY 2013, and 5% in FY 2014 and 2015. By FY 2015, the counties would be paying $337.5 million towards teacher pensions, of which $69.9 million would be paid by MoCo – easily more than anyone else. Furthermore, the payments would kick in just as federal stimulus money for education runs out. Here is the fiscal summary.

Most other MoCo policymakers had little or no warning of the proposal. That includes the vast majority of MoCo’s statehouse delegation and officials inside county government. This development surprised MANY people for the following reasons:

1. Madaleno is one of the top budget experts in the General Assembly and is Montgomery’s leader on those issues. He has stood up for the county’s interests in the past, leading a failed battle against the millionaire tax and opposing Prince George’s County’s efforts to grab more aid at MoCo’s expense. Madaleno knows better than anyone that teacher pension payment is one of the very few state aid programs that disproportionately benefits Montgomery. The county is fifth-from-the-bottom in state aid per capita overall but second-from-the-top in teacher pension payments per pupil in the state. For Montgomery, what state program besides transportation funding is more worthy of protection?

2. Perhaps more than any other county, Montgomery is in grave fiscal trouble. The county’s Chief Administrative Officer estimates the county’s future budget deficits at $519 million in FY 2012, $600 million in FY 2013, $683 million in FY 2014, $715 million in FY 2016 and $752 million in FY 2017. Why add tens of millions of dollars to those deficits?

3. Teacher pension is not only a Montgomery issue. The following counties derive a per-pupil benefit that is greater than the state average of $931 as of FY 2010 from the program:

1. Worcester: $1,134

2. Montgomery: $1,097

3. Kent: $1,050

4. Howard: $1,048

5. Somerset: $1,002

6. Baltimore City: $969

7. Prince George’s: $943

8. Allegany: $936

Despite the above benefit distribution, Howard County Senators Ed Kasemeyer (D-12) and James Robey (D-13), Baltimore City Senators Verna Jones (D-44) and Nathaniel McFadden (D-45) and Worcester/Somerset County Senator J. Lowell Stoltzfus (R-38) voted against their own constituents by supporting Madaleno’s proposal. Senate Budget and Taxation Committee Chairman and Prince George’s Senator Ulysses Currie (D-25) also voted in favor of it despite facing a possible challenge from Delegate Aisha Braveboy, who would be sure to use the issue against him if she ran.

Madaleno has enormous credibility in MoCo on budget issues, but he is taking some heat over this. One long-time admirer growled, “Rich is really off the reservation on this one.” Another observer was appalled, saying, “Wow, MoCo surrenders teacher pension without a fight.” Yet another complained about the lack of notice and said, “This is not the right way to do this.” And one influential policy maker, upon hearing of the cost to the county from the proposal, yelped, “We’re so screwed!”

Madaleno’s defenders offered theories to explain what happened while scratching their heads. One hypothesized that it was easier to negotiate with Governor O’Malley over the issue than with a possible Governor Ehrlich. Two more said that by offering a solution, Madaleno was earning MoCo a seat at the table. “If you’re not at the table, you’re on the menu,” said one veteran. Almost all our budget informants regard a partial handoff of pension obligations to the counties as inevitable. Even some of the fiercest public opponents concede - strictly off the record – that the counties are going to lose this issue. More than one believes that Madaleno’s proposal may be the best MoCo can get given the more draconian plans preferred by the likes of Big Daddy.

We will not raise the white flag until the last shot is fired. The teacher pension issue is hugely important to Montgomery County. It is not something to be given away for nothing in return because it affects our biggest long-term economic edge against our competitors in Virginia: the public schools. The Maryland Association of Boards of Education estimates that every $100,000 in pension costs passed down to the counties equals one-and-a-half to two teacher positions. MCPS is already preparing to increase average class size by one student due to existing budget problems. Montgomery cannot afford to maintain its per-pupil spending and will be applying for a state Maintenance of Effort waiver for the second straight year after never applying for a waiver in its previous history. What will happen to county schools if they bear even more budget problems? And how much more attractive will Fairfax become if MCPS suffers?

If Montgomery wants to preserve the quality of its schools, it must put up a tough fight and negotiate only when it has maximum leverage. That point is not now, but next year, when the next Governor – whoever it is – will have to pass a tax and spending package to deal with Maryland’s long-term budget deficits. Such a package cannot pass without MoCo’s votes. And that will be the time for the county to extract its terms on teacher pensions and anything else. As one of our spies says, “We are holding a handful of aces. Why fold when we can play them?”

Posted by

Adam Pagnucco

at

2:00 PM

![]()

![]()

Labels: Adam Pagnucco, budget, Rich Madaleno, State Aid, Teacher Pensions

Friday, March 19, 2010

Two Quick Facts About Montgomery County Public Schools

The latest Overview of State Aid to Local Governments contains two quick facts about Montgomery County Public Schools (MCPS) that state policymakers need to understand.

First, MCPS leads the state in the percentage of students with Limited English Proficiency (LEP). Only Prince George's County is close to MoCo on that measure.

Second, MCPS is fourth in the state in terms of minority percentage of its student body (61%). Only Baltimore City and Prince George's County have significantly higher percentages. MoCo is number one in Latino percentage and far exceeds anyone else other than Prince George's.

Despite the above facts, only about one-fifth of MCPS's budget is financed with state aid - a lower percentage than any Maryland jurisdiction other than Worcester and Talbot Counties.

MCPS derives such a low percentage of its budget from the state because state aid formulas are driven by relative wealth. If state aid were instead driven by measures of challenges facing school districts, MCPS would get a whole lot more.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, MCPS, State Aid

Monday, March 15, 2010

Baltimore on the Block

A recent Sun article indicates that the General Assembly is considering cuts to Baltimore’s highway aid from the state. We are not in the habit of defending aid to Baltimore, but we believe these legislators are barking up the wrong tree.

The state aid program under scrutiny is Highway User Revenues (HUR), which is a portion of the Transportation Trust Fund sent out to the counties and the City of Baltimore to pay for street maintenance and other transportation-related expenditures. The Governor’s original FY 2010 budget contained $480 million in HUR distributions, including $194 million for the City of Baltimore. But the General Assembly and the Board of Public Works both cut HUR sharply by transferring much of it to the general fund to plug deficits. (Ironically, the Democrats had once criticized former Governor Bob Ehrlich for “raiding” transportation spending.) Proposed HUR is now down to $140 million for FY 2010-2012, with Baltimore due to receive $130 million. General Assembly budget analysts are advocating that $30 million of that money go to other jurisdictions instead.

Why does Baltimore get so much HUR money? The reason is because the State Highway Administration (SHA) does not own or maintain any roads in city limits. In the rest of the state, nearly all of the arterials are maintained by SHA. In Montgomery County, SHA roads include Wisconsin Avenue/Rockville Pike, US-29, Georgia Avenue, Connecticut Avenue and even secondary streets like Piney Branch Road and Bradley Boulevard plus many, many more. SHA spends hundreds of millions of dollars maintaining its street network every year. The City of Baltimore gets none of that money. So if the city’s HUR proceeds are distributed elsewhere, city residents will have to pay for their own pothole repairs while other Marylanders will see their arterials kept up by the state. Even such a MoCo partisan as your author would hesitate to do that to Baltimore.

But that does not mean the city should go untouched. In fact, Baltimore is the beneficiary of three special deals that no other jurisdiction gets: the state has assumed responsibility for its community college, detention center and central booking facility. In FY 2011, those costs are projected to total $182 million.

There is absolutely no reason why every other jurisdiction should have to bear responsibility for its own community college and jail while Baltimore gets a free ride. The city should be treated the same way as everyone else. And since the state sends aid to subordinate jurisdictions on the basis of wealth formulas, the city would likely get a big chunk of its college and jail costs from the state anyway.

The General Assembly should treat all of Maryland fairly. That means letting Baltimore keep its street maintenance money but also ending its illegitimate freebies once and for all.

Posted by

Adam Pagnucco

at

2:00 PM

![]()

![]()

Labels: Adam Pagnucco, Baltimore, State Aid, transportation

Friday, March 12, 2010

Where Do the Counties Rank on Returns from the State?

Ten-year data comparing state aid to state taxes paid by county illustrate a truth we all know: Maryland is a state of donors and recipients. Here are who’s giving and who’s getting.

Page 107 of last year’s Overview of Maryland Local Governments shows the amount of state aid and payments-on-behalf (like teacher pensions) per dollar of state taxes paid for each of the state’s 24 jurisdictions. We reproduce it below.

Over the FY97-06 period, Montgomery County received 15-19 cents in aid and payments-on-behalf for every dollar in taxes its residents paid to the state. Only Worcester (11-13 cents) and Talbot (11-14 cents) received less. The biggest recipients were Somerset (91-114 cents), Caroline (91-107 cents) and Baltimore City (81-108 cents). The state average was 34-40 cents over the ten-year period.

There is a major omission from the above data: transportation spending. Of the $9.1 billion six-year Consolidated Transportation Program, the ICC accounts for $2.6 billion and WMATA will receive $658 million in debt service and $1.3 billion in construction spending and equipment. (A lot of the above funds are federal.) But the ICC and Metro serve many non-Montgomery residents and their inclusion would not come close to eradicating Montgomery’s status as a donor county.

Why does Montgomery do so poorly? We explored this issue in 2008’s MoCo: Not as Rich as You Think series. On the one hand, Montgomery residents need higher salaries to pay for higher costs for gasoline and real estate. The state’s income tax brackets, which treat income equally in every jurisdiction without regard for costs, pinch Montgomery’s residents harder than elsewhere. And on the other hand, most of Maryland’s aid is driven by wealth formulas that depend heavily on real estate values. High home prices in Montgomery may mean more home equity for some, but they also mean higher mortgage payments. In 2006, Montgomery mortgage holders paid an average $2,285 per month, the highest in the state.

The net effect of the system is to drain Montgomery residents of both tax dollars and aid. High nominal salaries are needed for high real estate and fuel prices, which ripple through to increase other costs in the county. Uniform state income tax brackets capture disproportionate amounts of that income. High home prices lead to greater wealth calculations in state formulas, which reduce state aid. And the county government must react by raising its property taxes to make up for relatively low state aid levels.

Anyone up for moving to Crisfield?

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, budget, Maryland, Montgomery County, State Aid

Thursday, February 18, 2010

Prince George's Tries to Strongarm MoCo for Aid - Again

The Post has reported on yet another attempt by the Prince George’s County statehouse delegation to acquire more state aid at the expense of Montgomery County. Of course, Prince George’s attempted to do this to MoCo just a year ago. A few statistics are in order.

Our sources are the FY 2011 Overview of State Aid to Local Governments, the Tax Year 2008 Income Tax Summary Report, the FY 2009 Sales and Use Tax Report, the Washington Area Boards of Education FY 2010 report and the U.S. Census Bureau’s 2008 American Community Survey.

Per Capita Income Tax Paid to the State, Tax Year 2008

Prince George’s: $600.60

Montgomery: $1,590.35

Note: 2008 population from the Census Bureau used for this calculation.

Per Capita Sales Tax Paid to the State, FY 2009

Prince George’s: $499.57

Montgomery: $538.80

Note: 2008 population from the Census Bureau used for this calculation.

Per Capita State Aid, FY 2011

Prince George’s: $1,305

Montgomery: $807

Per Pupil Direct Aid to Public Schools, FY 2011

Prince George’s: $7,324

Montgomery: $3,796

Percent of Public Schools Budget Paid by the State, FY 2010

Prince George’s: 50.7%

Montgomery: 20.5%

The truth is that Montgomery County, Howard County, Anne Arundel County and the Baltimore suburbs have been carrying Prince George’s County on their backs for years. And Prince George’s has rewarded the rest of the state’s investment with disastrous schools, a scandal-plagued police department, WSSC commissioners who are obsessed with minority contracting and not with repairing broken pipes and the abominable administration of County Executive Jack Johnson. But that is not enough – now they want more state aid. And you know what? They have a good shot at getting it for two reasons.

1. Wayne Curry

The former Prince George’s County Executive is publicly considering a challenge to Governor O’Malley. The Governor is eager to ward off Curry, and if that does not work, he would like to co-opt Curry’s support in Prince George’s County. That explains his remark to the Prince George’s Delegation: “The bottom line is we do want to work with you.” Translation: please don’t hurt me!

2. Political Hardball

Montgomery County’s politicians endorsed O’Malley en masse last fall while many Prince George’s politicians shrewdly withheld their support. Prince George’s Delegate Dereck Davis (D-25), the powerful House Economic Matters Committee Chairman who did not endorse O’Malley, explained his decision this way to MPW:...I have not endorsed anyone for Governor. Quite candidly, I think it is premature to endorse anyone until after the 2010 legislative session has been completed. Then, and only then, will I be able to make an informed decision about what’s best for the community I represent.

This is a very smart decision by Delegate Davis and a good part of the rest of his delegation. MoCo politicians gave away their support to O’Malley in return for nothing. Prince George’s politicians are using their leverage to extract concessions. Good for them.

The bottom line is that MoCo pays more than its fair share to the state and gets less in return. MoCo is facing a $690 million deficit at the moment, and that was before the blizzards. If the MoCo delegation gives in to Prince George’s attempts to get more aid at their expense, they should not bother to come home after the session. They should instead run for office in Prince George’s County, because after all, that would be their true constituency.

Posted by

Adam Pagnucco

at

2:00 PM

![]()

![]()

Labels: Adam Pagnucco, Montgomery County, Prince George's, State Aid

Monday, November 09, 2009

Marc Elrich Comments on School Funding Dispute

County Council Member Marc Elrich, a former 5th grade teacher at MCPS for many years, offered the following comments about the county’s school funding conflict with the state.

#####

The State BOE (Board of Education) is fundamentally wrong on this one. The compromise would have been to grant us a waiver the right way. To be sure, they are not qualified to judge either the state of the economy or the state of our budgets. The absurdity of their decision shows that.

The only reason we did not make MOE (maintenance of effort) is because the unions gave back their COLAS. The value of that act by the unions, as part of something all the unions did to help us avert a total budget meltdown, was virtually equal to the amount we didn't spend in failing to meet the MOE. In short, if we'd funded the union contracts, we'd have met MOE. We failed to meet it by the value of those contracts.

But, if we’d funded those contracts, we’d have had to fund all of the other union contracts because they were to be treated the same. The cost to the County would have been around $125 million total. To find the $125 million, we’d have had to cut that amount from the government side of the budget (since any cuts to schools would have brought them under MOE again.) There is no way that that could have been achieved without massive layoffs. It’s a number so big that it could not be done with furloughs. It would have cost a very large number of jobs and substantially reduced services. It was a very bad option.

The fundamental issue is this. If in hard economic times you fail to meet MOE because the labor unions are willing to reduce their contracts, you should get a waiver. This is not a reduction in spending in the classroom, it doesn’t increase class size and it doesn’t reduce educational programming, all of which are the laudable intentions behind the MOE law in the first place.

The Board’s application of the law leads to even more absurd implications. If the Superintendent found a way to reorganize administration that saved $25 million dollars and if school budget is then $25 million less than MOE would require, then you’d fail to meet MOE and get penalized. How nuts is that? Under the current rules, you can’t save money, you can only spend more money. Something is seriously not right here. It defies logic, it disincentivizes any effort to be more efficient, and it punishes schools if unions contribute to balancing the budget. It’s just wrong.

I would hope that there’s an honorable way out. The State BOE actually can’t force the County to do anything. What they would do is reduce funding to the school system which would only make the school funding situation worse! The County budget outlook is not improving. We don’t have the money. A confrontation over this will not produce a good outcome.

The other important point is that the county has routinely exceeded the MOE requirement, year after year. It has never been the County policy to fund as little as is needed to pass the State MOE requirement, but rather to spend as much as it can toward providing the best education possible. So for years, the County has poured money into the schools. Yet for this test, none of that matters. The fact that our failure to meet this year’s MOE is because, in part, of our history of spending even more than required was totally ignored by the State. And what message does that send to the Counties? Don’t spend above the MOE level because if you ever find yourself in an economic bind, your history of doing everything you can won’t count for beans and, in fact, your higher levels of past spending will drive even higher MOE requirements. It’s like being punished for doing a good thing.

Posted by

Adam Pagnucco

at

12:00 PM

![]()

![]()

Labels: Board of Education, County Budget 2010, Maintenance of Effort, Marc Elrich, State Aid

Saturday, November 07, 2009

Weast Throws Council Under the Bus on School Funding Dispute (Updated)

In a statement released to the media but not to County Council Members, MCPS Superintendent Jerry Weast puts the blame squarely on the council for the county's setback on school funding. Weast has long run an empire at MCPS, with an independent line to the Washington Post's editorial writers and a condescending attitude to his board and local elected officials. But the blunt language and threatening final paragraph in his statement is sure to draw fury from Rockville.“I’m disappointed, but not surprised, at the Attorney General’s ruling. We had serious concerns that the County Council’s plan did not meet the Maintenance of Effort provision and, unfortunately, we were correct. Now, we may face a fine from the state and the brunt of that burden will be felt by our students and teachers at a very critical time.”

Update: Council Member Valerie Ervin, Chair of the Council's Education Committee, has called Weast a “rogue superintendent.”

“We were trying to do the right thing: We wanted to help the county with its budget problems. We asked the state for a waiver of the MOE provision and we were denied. We offered suggestions and ideas to the County Council for legal ways we could help them and we were not listened to. In the end, we had a solution pushed upon us that, it turns out, was illegal. I guess no good deed goes unpunished.”

“Over the next several days, we will be discussing the impact of this ruling. I can promise you this: We will have a full Maintenance of Effort budget in fiscal year 2011. Never again will we put our employees and students in this position.”

Posted by

Adam Pagnucco

at

12:00 PM

![]()

![]()

Labels: Board of Education, County Budget 2010, Jerry Weast, Maintenance of Effort, MCPS, State Aid

Friday, November 06, 2009

MoCo School Funding Dispute: A Way Out

The intense school funding dispute now raging between the Montgomery County government and the Maryland State Department of Education (MSDE) may be headed to court. But it does not have to go that far. There is real potential for a settlement that gives each party what it needs without giving either everything it wants. Here’s what a deal looks like.

What the County should give the State

MSDE is overseen by the State Board of Education, whose members are appointed by the Governor and in turn appoint the State Superintendent of Schools, Nancy Grasmick. One of the principal responsibilities of MSDE and the Board is to monitor state aid to public schools, now totaling $5.5 billion or 40% of the state’s general fund. State aid to local schools has gone up by 83% since the passage of the 2002 Thornton Act, a factor credited by many for the state’s number one public schools ranking by Education Week. But increases in state aid come with a catch: the recipient counties must not cut their own spending on their schools, a provision known as “maintenance of effort” (MOE). The Board is very protective of this requirement since it is a cornerstone of the state’s education policy.

After the Board rejected Montgomery County’s waiver request to excuse it from sending $79 million to its school district, the county responded by charging the schools $79 million for debt service on capital projects. At the Board’s request, Attorney General Doug Gansler issued an opinion denouncing the county’s move as “artificial.” The county has responded with strong language against the Board’s action and the Attorney General’s opinion and has threatened to sue.

The county must understand the Board’s position. It is the Board’s responsibility to enforce state aid requirements impartially across all counties. Montgomery was not singled out as the Board also rejected waiver requests from Prince George’s and Wicomico Counties. When Montgomery claimed in its request that the tax-limiting Ficker Amendment prevented it from raising revenues, the Board responded that local tax caps were no excuse for evading state law.

Montgomery’s leaders must also understand that a lawsuit would pit them against State Superintendent Nancy Grasmick, the ultimate survivor of state politics. Grasmick has friends in both parties across the state and thwarted an attempt by Governor O’Malley to eject her, a rare defeat for a Democratic Governor on a personnel matter. Grasmick’s political capital is also high because of the state’s number one schools ranking. Finally, Grasmick has a difficult relationship with MCPS Superintendent Jerry Weast, with each believing that they are the top school official in the state. She is a formidable opponent for any adversary and may prove too much for Montgomery’s leaders to handle.

For Grasmick, the Board and MSDE, this is more a matter of policy than money. The county must recognize their legitimate role in overseeing state aid and enforcing state law. County officials must cease their excessive rhetoric against the state, stop defending their budget gimmick that Gansler rejected and that would not stand much of a chance in court and promise to never do it again. All of this would allow the state to move towards responding to the county’s legitimate needs.

What the State should give the County

What so outrages Montgomery’s leaders is that the county has been a leader in local school funding for decades, a fact that has been ignored by the state during this dispute. In FY 2007, the county was third from the top in per capita spending on its schools.

Meanwhile, the county is third from the bottom in per capita state school aid among Maryland’s twenty-four jurisdictions.

Montgomery County residents pay billions for their own schools and hundreds of millions more for schools in other parts of the state every year. Indeed, the state’s financial structure has depended on huge transfer payments from Montgomery, Howard and other “wealthy” areas for decades. But Montgomery is not as rich as the state believes and its current budget crisis is real. After two bad budget years, the county is looking at another giant deficit that could total $410 million, and that is before any more state aid cuts. County employees are likely to go a second consecutive year with no cost of living increases. Layoffs and/or furloughs are a real possibility. If the state forces the county to transfer $79 million to the schools and adds penalties to that amount, it will force the county to either ravage its police, fire, planning and human services or endanger its bond rating. How can the state not see the county’s fiscal calamity as legitimate grounds for a waiver? And how is further budgetary mayhem in the state’s interest?

And so if the county concedes the State Board of Education’s role and promises to not repeat its discredited budget gimmick, the state should respond with a symbolic, non-monetary penalty. Precedent will be respected, the principles of the Thornton Act will be preserved and the General Assembly can revisit the circumstances under which maintenance of effort waivers should be granted during the next session.

This deal can happen and should happen. And if the parties cannot resolve the matter themselves, the Governor should step in. It’s time to shut up, sit down and work it out. Lord knows there will be more to fight about soon enough.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, Board of Education, County Budget 2010, Maintenance of Effort, State Aid

Thursday, November 05, 2009

MoCo Threatens to Sue the State Over School Funding

An increasingly explosive dispute between Montgomery County and the state government over public school funding looks like it may be headed to court.

This morning, the Post reported that Attorney General Doug Gansler had found the county's attempt to meet state requirements on school funding to be illegal. We explained the state's rules on school funding last May: counties are required to spend at least as much of their own money on public schools each year as they did in the prior year, with only exceptional circumstances allowing for a waiver. Last spring, Montgomery County applied for a waiver based on its poor economy and the tax-limiting Ficker Amendment and was turned down by the state. The consequence was that the county owed $79 million more to the school system than it had budgeted. We argued that the county should use money it had set aside for reserves to pay the school system, but the county opted for a budget gimmick instead. The county decided to send $79 million more to the schools, but then charge them the same amount for debt service related to construction projects, a practice it had never instituted in the past. We called that move a "desperate budget gamble" and Gansler's opinion now threatens millions of dollars in penalties.

The response by County Executive Ike Leggett and County Council President Phil Andrews to Gansler is two-fold. First, they criticize the school funding law (called "maintenance of effort") and repeat their claim that the state was wrong to deny the county's waiver request. (We analyzed the state's reasoning for denial here.) Leggett and Andrews discuss the need for unspecified "legislative remedies," but they are not likely to come for many months if they come at all. Second, the Executive and Council President openly threaten to sue the state. Maryland's schools are currently ranked as the best in the nation and MCPS is its biggest local system. Any school-related lawsuit between the nation's top-ranked state and one of its top-ranked counties would be a disaster for all sides.

We reprint the press release from the County Executive and the Council President below.

Statement by County Executive Isiah Leggett and County Council President Phil Andrews on the Attorney General’s Opinion on the County’s Compliance with the Maintenance of Effort Provisions of State Education Law

November 5, 2009

“The opinion by the Attorney General that Montgomery County did not meet the State’s Maintenance of Effort school funding requirement is disappointing – and wrong.

“This opinion second-guesses local efforts to fully fund the needs of County school kids and meet critical County needs during this unprecedented fiscal time and limits the flexibility of local County and school officials to craft responses to the challenges before us.

“This opinion ironically could penalize our school children. It potentially forces cuts in school programs, and even further cuts in critical services such as public safety, libraries, and help to the most vulnerable County residents.

“That’s why Montgomery County will exercise all options to challenge this opinion. We are prepared to sue the State of Maryland – and we will aggressively pursue legislative remedies to a law that is fatally flawed.

“Montgomery County has shown its strong commitment to public education by devoting nearly half its budget – year in and year out – to K-12 education, far above and beyond what has been required by the State of Maryland. Over the past decade the County’s support for our schools has exceeded the State’s Maintenance of Effort requirement by a total of $576.8 million. To be penalized now for this outstanding support would be nonsensical.

“During the past decade, MCPS enrollment has risen by 5.4 percent while our local contribution to the schools increased 75 percent. For the past two years, even with fiscal challenges, we have significantly reduced both the overall capital and operating budgets of the County government in order to ensure that our schools had the necessary resources.

“Only the severity of the economic downturn and the dire consequences for the County’s overall budget caused us to request a waiver this year and ultimately to pursue a sound way to meet the Maintenance of Effort requirement. Despite these challenging conditions, we still funded 100 percent of our School Board’s education request. Any penalty imposed by the State on the County school system for ‘inadequate’ local support of public education would defy common sense and would be a gross waste of scarce funds in hard times.

“Montgomery County continues to support our world-class school system while sustaining critical programs in public safety, safety net services for our most vulnerable County residents, and initiatives to support our children and youth.

“We cannot accept this opinion as the final word. Too much is at stake – for County students and for County residents dependent on critical services.”

# # #

Contact:

Patrick Lacefield, 240-777-6528

Neil Greenberger, 240-777-7939

Posted by

Adam Pagnucco

at

10:00 AM

![]()

![]()

Labels: Board of Education, County Budget 2010, Maintenance of Effort, MCPS, State Aid

Thursday, August 27, 2009

Three Local Aid Questions

Here's three questions about the Governor's local aid cuts that should interest everyone who lives outside the City of Baltimore and Prince George's County.

1. Why was police aid cut by 17% in Prince George's County and by 35% everywhere else?

2. Why were highway user revenues cut by 19% in Baltimore City and by 90% everywhere else?

3. Community college aid was cut by 5% in every jurisdiction except for Baltimore City. Baltimore City Community College's costs are entirely covered by the state, an amount originally set at $42.6 million in the Governor's proposed FY 2010 budget. Was this funding also cut by 5%?

Local health aid was cut by 35% for every jurisdiction, the only category in which an equal percentage was applied everywhere.

Yesterday, Montgomery County Executive Ike Leggett said that the Governor had been "fair in his distribution of cuts." Did his staff review this information first?

Posted by

Adam Pagnucco

at

2:00 PM

![]()

![]()

Labels: Adam Pagnucco, Baltimore, budget, Prince George's, State Aid

Tuesday, August 25, 2009

Local Aid Cuts Focus Heavily on Transportation

The O'Malley administration just announced $454 million in new cuts, of which $210 million consisted of cuts in local aid. The aid cuts stripped $20.1 million from local health programs, $20.6 million from police departments, $10.5 million from community colleges and a whopping $159.5 million from highway user distributions, or local transportation aid. The transportation cuts amount to one-third of the savings.

Highway user revenues are the primary source of transportation aid distributed by the state to its 24 local jurisdictions. We explained the program in a prior blog post:Highway user revenues (HUR) are composed of gas taxes, vehicle titling taxes, vehicle registration fees, short-term vehicle rental taxes and a small portion of corporate income taxes. Currently, 70% of HUR is dedicated to the state’s Transportation Trust Fund (TTF) and the remaining 30% is distributed to counties and municipalities. Baltimore City, which does not have state highways inside its borders, is guaranteed at least 11.5% of the local distribution. The remaining local distribution is divided among the jurisdictions according to a formula which relies on county shares of road miles and county shares of registered vehicles. Below is the planned distribution of HUR by county from the Governor’s original FY 2010 budget proposal:

Below is the distribution of the local aid cuts proposed by the Governor:

Below is the distribution of the local aid cuts proposed by the Governor:

Baltimore City's reduction is the greatest because it receives more HUR than any other jurisdiction, and 76% of the local aid cuts are comprised of HUR.

Counties primarily spend transportation funds on system preservation, which former MDOT Secretary John Porcari said was the best way to use infrastructure spending for stimulus. The General Assembly already diverted more than $200 million in HUR to deficit reduction in March. By cutting HUR again (this time by half), the state will exert a depressing effect on the economy if the counties cut their own transportation spending, thereby at least partially offsetting federal transportation grants.

If this is the beginning of a strategy to balance the budget by cutting transportation, how can we afford to pay our share of the Red Line, the Purple Line and the CCT, especially if more than one of them goes ahead?

Posted by

Adam Pagnucco

at

5:00 PM

![]()

![]()

Labels: Adam Pagnucco, budget, State Aid, transportation

Thursday, July 30, 2009

Sectarian Conflict, Maryland Style

We like arguing with Baltimore Sun transportation reporter Michael Dresser. He’s an honest, vigorous advocate for his city and his region. Posing as his alter-ego, “Baltimore Guy,” Dresser wrote a column blasting the I-270 widening project. After we pointed out all the things Baltimore received from the state, Dresser offered this response: Adam:

We love honesty and Dresser gave us a big dose of it. This is far better than listening to another awful “we’re all in it together” speech!

I showed Baltimore Guy your article, and he wasn't at all pleased. I think you hurt his feelings. -- Mike Dresser

“What is this Montgomery tofu-head trying to put over on me, anyway? Has all that brie rotted his brain? Does he think Baltimore wants to keep feeding on crumbs from Montgomery’s table? Shove that! We want more of the feast. We can take all the growth that comes our way without whining about traffic.

“And if we don’t get high-tech jobs in Baltimore, we want them a lot closer than freaking Montgomery County. My kid, who just graduated from UM with a computer sciences degree, doesn't want to commute to Gaithersburg even with the ICC because the tolls will cost an arm and a leg. He’d rather get a job somewhere on Interstate 95 where people won’t look down on him because he drinks Natty Boh instead of Cos-mo-pol-i-tans.

“And why does this guy keep going on about Baltimore city? Doesn’t he realize he’s up against Baltimore County and Howard County and Harford and Anne Arundel too? None of us get squat from new jobs along I-270. We want them on the eastern end of their precious ICC. And it just so happens we have pals in Prince George’s and Southern Maryland and the Eastern Shore who feel the same way.

“So why don’t we all have a meeting in Annapolis and let those Montgomery County liberals explain to us all again how much we owe them and how only Montgomery is worthy to be a job creator and how they’re generously offering to absorb more traffic for the good of the state? We’ll show them gratitude.”

OK, Baltimore Guy, back in your box. We want to keep it civil here.

Sorry, Adam, Baltimore Guy’s been a little touchy since his industrial base went away.

For all the sound and fury surrounding the I-270 project, it will not be the near-term battlefield for Free State sectarianism. The real conflict will take place over the FY 2011 and FY 2012 state budgets. We have blogged several times about Senate President Mike “Big Daddy” Miller’s intention to send teacher pensions down to the counties, a move that would disproportionately devastate MoCo. The state’s never-ending budget disaster makes that much more likely next year or the year after. But for all the talk about ending the one state program that may actually benefit MoCo in net terms, no one is discussing ending the state’s 100% subsidy for Baltimore’s Community College, Detention Center and Central Booking Facility. Let’s view once again the state’s $185 million handout from the Governor’s FY 2010 budget – a special deal that no one else in Maryland can ever hope to get.

What would happen if that aid ever wound up on the chopping block? The Baltimore delegation would fight like hell and the Sun would have their backs. Meanwhile, the Washington Post’s clueless Boy King has already asked the Governor to send teacher pensions down to the counties.

We hope our state delegation understands what they’re up against.

Posted by

Adam Pagnucco

at

7:00 AM

![]()

![]()

Labels: Adam Pagnucco, Baltimore, budget, I-270, State Aid, Teacher Pensions, transportation