As Montgomery County's budget battle draws to a clamorous climax, a new bomb has been dropped.

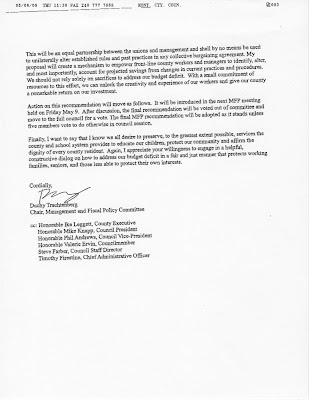

Yesterday, Council Member Trachtenberg sent the following letter calling for a 2 percent cost of living reduction to each of the county's public sector unions:

The unions countered in two ways.

1. In a letter to Ms. Trachtenberg sent today, MCEA, SEIU Local 500 and the school supervisors listed $67 million in new revenues available to the council next year. Those revenues include:

$14 Million

Adjustments in OPEB [contributions to future retiree healthcare liabilities]; would allow for 8 year payout, but does not assume the same level of increase; $11 million in savings from MCPS and $3 million from other agencies.

$9 Million

Net gain from increases in energy tax [as proposed by Council Member Floreen].

$10 Million

Could be taken from PAYGO.

$19 Million

Reduction of .5% into the reserve [maintained by the county to protect its AAA credit rating].

$15 Million

Potential carry-over carry over funds that were set aside in the FY 08 budget for emergencies, such as snow removal that were not needed.

2. In their letter to Ms. Trachtenberg, the unions state, "An additional source of revenue is to take into account any revenues in excess of projections in the current budget. We have no knowledge of what that figure is since it has not been shared by the County Executive’s office." Indeed, rumors are flying that the county's income tax receipts may be higher than first thought. The unions have sent a Freedom of Information (FOIA) request to the County Executive's office seeking a monthly tabulation of new income tax revenues received from the state. They hope to discover evidence that income tax receipts are higher than projected, thus relieving the pressure on their contracts.

One of the sad aspects of this showdown is that it may not be necessary. A week ago, we demonstrated to our readers that the County Executive's budget projects $301 million in new revenues for FY09 against $154 million in added union labor costs. At least for next year, labor's cost of living adjustment is easily affordable. Nevertheless, the hammer is falling.

In the private sector, an employer could not do what the county is considering. If a private company attempted to unilaterally change a labor agreement, the union could strike, file unfair labor practice charges, get enforcement orders from the National Labor Relations Board and the courts and file suit to collect benefit contributions. Only employers under bankruptcy protection could unilaterally alter wage levels. Montgomery County may be in a recession, but it is not under the supervision of a bankruptcy judge!

The fate of the unions' COLAs is far from certain. Council Members Trachtenberg and Phil Andrews can block the County Executive's proposed property tax increase, which requires seven of the eight sitting council members to pass. But altering the union contracts would require five votes. It may be difficult for Ms. Trachtenberg and Mr. Andrews to find three more council members willing to cut the COLAs when there are less electorally-threatening alternatives available.

And if the council simultaneously rejects the property tax hike and rejects COLA reductions, what then? No one knows. But the choice must be made in less than a week.

Friday, May 09, 2008

Labor Between the Hammer and the Anvil

Posted by

Adam Pagnucco

at

6:50 AM

![]()

![]()

Labels: Adam Pagnucco, budget, County Budget 2008, County Employees, Duchy Trachtenberg, MCEA, MCGEO, Montgomery County Council, Phil Andrews, Public Employees, SEIU Local 500